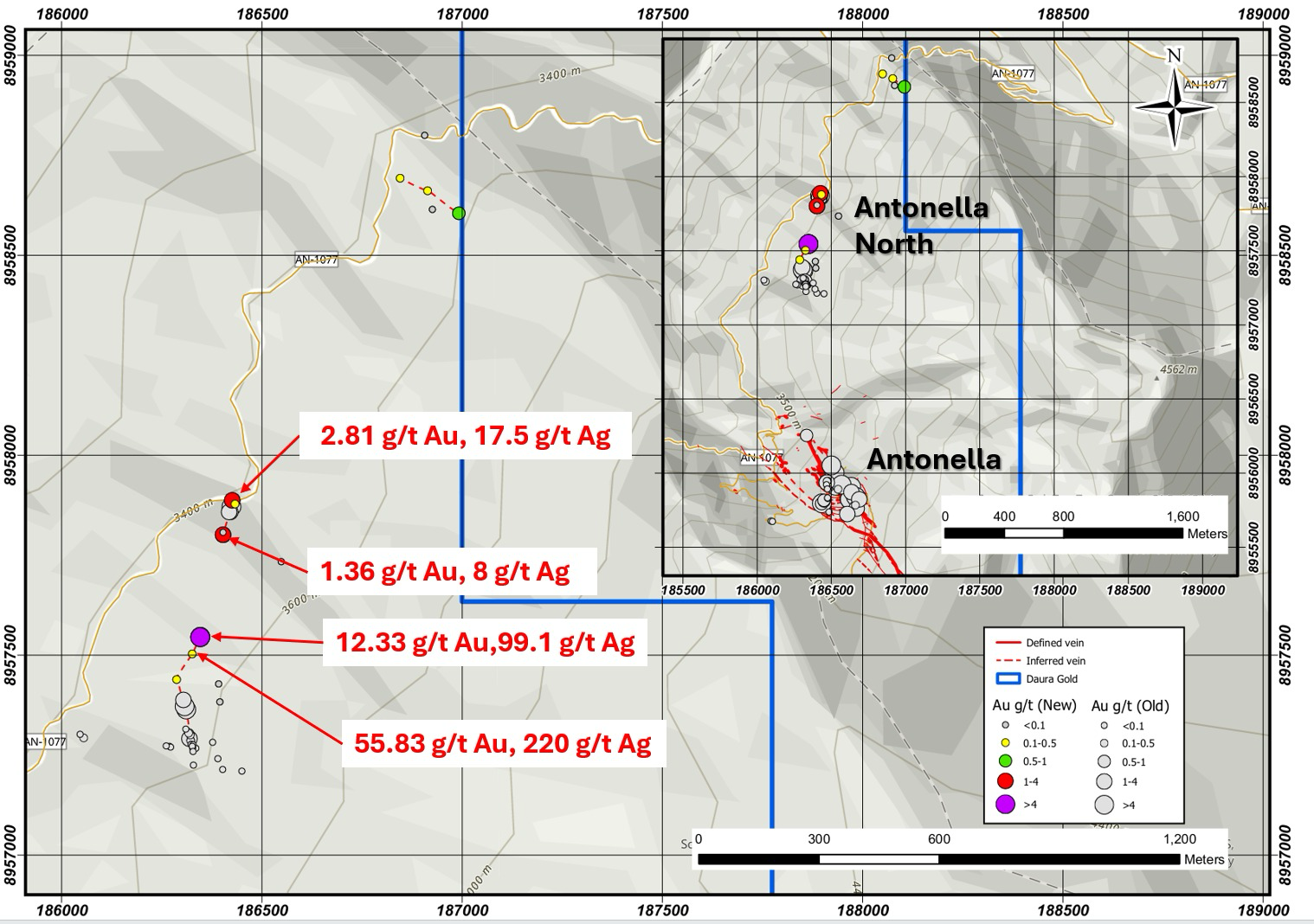

Vancouver, British Columbia — (May 6, 2024) – Daura Capital Corp. (TSXV:DUR.P) (the “Company” or “Daura”) is pleased to announce it has entered into a new letter of intent (the “LOI”) with Estrella Gold S.A.C (“Estrella”), a privately held Peruvian gold company, pursuant to which Daura proposes to acquire a 100% interest in Estrella. Estrella holds a series of gold concessions in the Ancash Region of Northern Peru. Estrella’s primary target is a high-grade gold-silver project called Antonella. The Antonella concession was previously owned by Minera Silex Peru SRL, which conducted drilling and sampling on 11 holes located on the Antonella Concession. Antonella is adjacent to the San Luis gold-silver project, recently acquired by Highlander Silver Corp. (CSE:HSLV).

Daura is a "capital pool company" under the policies of the TSX Venture Exchange (the "Exchange"). It is intended that the acquisition of Estrella will constitute Daura’s "qualifying transaction" under the policies of the Exchange (the "Qualifying Transaction"). Upon completion of the Qualifying Transaction, the resulting entity (the "Resulting Issuer") is expected to be a Tier 2 Mining issuer under the policies of the Exchange. It is expected that the Qualifying Transaction will not constitute a Non-Arms Length Qualifying Transaction as defined under the policies of the Exchange, and approval from the shareholders of Daura is not expected to be required.

The Qualifying Transaction

The LOI was signed by the parties on May 1, 2024, and sets out certain non-binding understandings and binding agreements between Daura and Estrella. The LOI constitutes an agreement in principle with respect to the Qualifying Transaction pursuant to the policies of the Exchange. Pursuant to the terms of the LOI, it is expected that Daura and Estrella will negotiate and enter into a definitive agreement incorporating the principal terms of the LOI.

Subject to any Exchange, regulatory, or other approvals that may be required, the completion of satisfactory due diligence by Daura and Estrella, the completion of the Daura Financing (as described below), and the satisfaction of other conditions contained in the LOI, it is currently anticipated that Daura will issue a total of 7,000,000 common shares (“Daura Shares”) at a deemed price of $0.06 per share to acquire Estrella. No finder’s fees or commissions are expected to be paid in relation to the Qualifying Transaction. No loans or advances are expected to be made to Estrella in connection with the Qualifying Transaction. However, Estrella is currently indebted to Daura in the principal amounts of $75,000 and US$115,000, which funds were advanced by Daura to Estrella in connection with Daura’s previous attempt to acquire Estrella in 2021 and 2022, which transaction was terminated by mutual agreement of the parties.

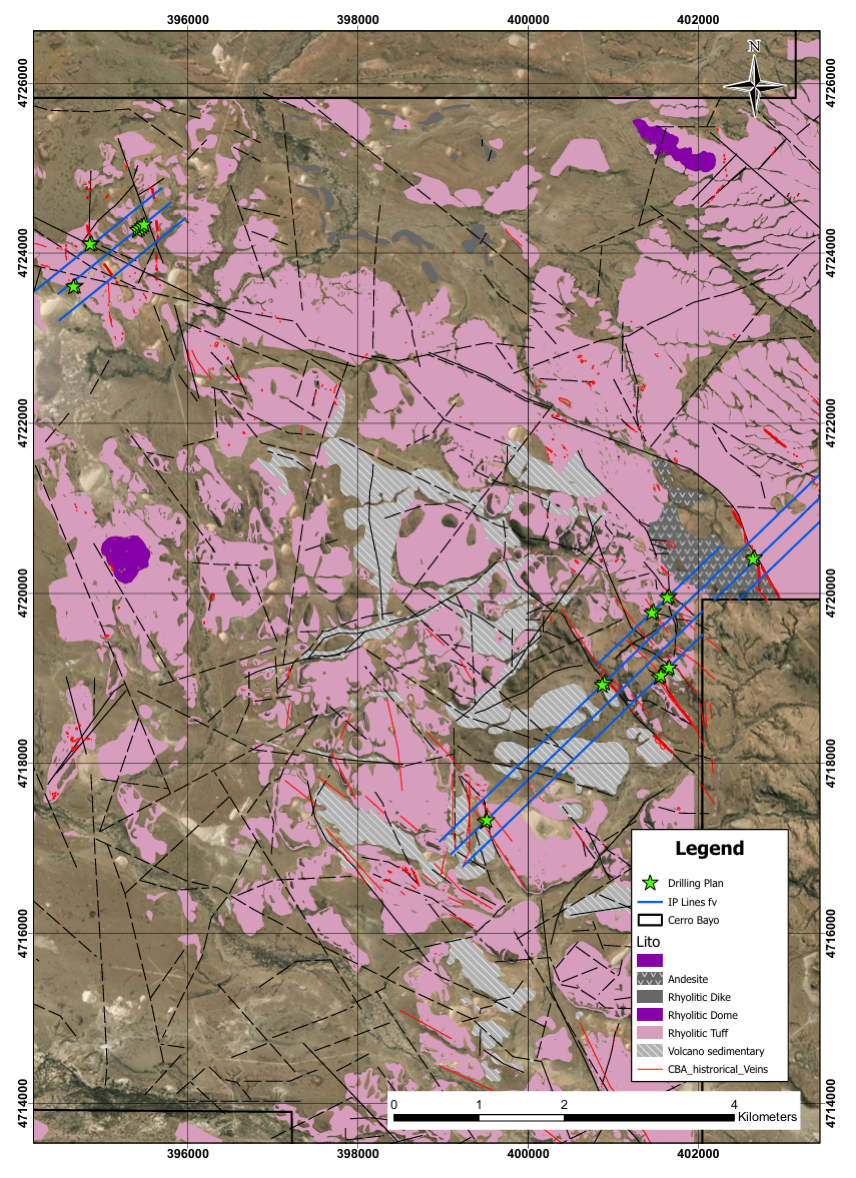

Estrella currently holds a 100% interest in 10 exploration concessions covering 6,900 hectares and a 100% interest in the Antonella Gold Project, a 900-hectare exploration concession. The Estrella Gold tenements, along with Antonella, are located in the Cordillera Negra of north-central Perú, 513 kilometers north-northwest of Lima and 113 kilometers east of the city of Casma.

Antonella is adjacent to the San Luis gold project, which was recently acquired by Highlander Gold. Highlander has stated they believe San Luis is the highest grade, undeveloped gold project in the world. Daura believes Antonella has potential to become a critical component of this underexplored gold district.

Upon completion of the Qualifying Transaction, the resulting entity (the “Resulting Issuer”) will be engaged in the business of mineral exploration and development of the Estrella concessions and Antonella Gold Project. In addition, the Resulting Issuer may explore and develop such other properties and interests as may be subsequently acquired by the Resulting Issuer. Upon completion of the Qualifying Transaction, it is currently anticipated that Daura’s existing directors and officers will remain with the Resulting Issuer, and Dr. Ernesto Lima Osorio, the majority shareholder of Estrella, is expected to join the board of directors of the Resulting Issuer.

Dr. Ernesto Lima Osorio (Director) is the majority shareholder of Estrella. Dr. Lima has over 25 years of experience in the mining and exploration business across South America. Dr. Lima has been responsible for numerous mining development and construction projects throughout Uruguay, Brazil, Chile, Venezuela, Argentina, and Peru. Dr. Lima’s notable engineering and construction experience in South America includes engineering and development of the San Gregorio gold mine in Uruguay for Rea Gold Corporation, construction and engineering of the $450 million Pirquitas open-pit silver mine in Argentina for Silver Standard Resources, and engineering and construction of the Tucano Gold-Iron Mining Project in Brazil for Beadell Resources Ltd. Dr. Lima was previously Chief Operating Officer for Valor Resources Limited, an ASX-listed metals company focused on the development of the Berenguela Polymetallic Project in the Puno Department of Peru, and is currently COO and Director of Bifox Ltd.

Dr. Lima holds an engineering degree from the University of the Republic in Montevideo, Uruguay, an MBA from ORT University in Montevideo, and a Doctorate in Management with a focus on mining projects from University of Phoenix, USA. Dr. Lima is a resident of Montevideo, Uruguay, and speaks fluent English, Portuguese, and native Spanish.

Background information for Daura’s existing directors and officers may be found in the Company’s prospectus dated July 26, 2019, and available on www.sedar.com.

Proposed Financing

Pursuant to the terms of the LOI, Daura anticipates completing a financing of subscription receipts for minimum proceeds of $1,000,000 and maximum proceeds of $1,500,000 (the “Daura Financing”). The Company may retain a broker or pay finder’s fees to certain registrants or eligible persons exempt from registration on any portion of the Daura Financing. The net proceeds of the Daura Financing will be used: (a) to fund the business plan of the Resulting Issuer; (b) for Qualifying Transaction expenses; and (c) for general working capital purposes. Additional details regarding the Daura Financing will be provided in due course.

About Estrella Gold S.A.C.

Estrella is a private company incorporated under the laws of Peru. Estrella is focused on the acquisition, exploration, and development of precious metals properties in Peru. Estrella’s head office is located in Lima, Peru.

Sponsorship of the Qualifying Transaction

Sponsorship of a Qualifying Transaction of a capital pool company is required by the Exchange unless exempt in accordance with Exchange policies. Daura is currently reviewing the Exchange’s requirements for sponsorship to determine if it may seek a waiver of the sponsorship requirement.

Additional Information

In accordance with the policies of the Exchange, the Daura Shares are currently halted from trading and will remain halted until further notice.

Daura and Estrella will provide further details in respect of the Qualifying Transaction, in due course once available, by way of press releases.

All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by management of Daura.

If and when a definitive agreement between Daura and Estrella is executed, Daura will issue a subsequent press release in accordance with the policies of the Exchange containing details of the definitive agreement and additional terms of the Qualifying Transaction, including, but not limited to, information relating to Estrella’s properties, sponsorship, summary financial information in respect of Daura and Estrella, the names and backgrounds of all persons expected to be Principals and Insiders of the Resulting Issuer, and additional information with respect to the Daura Financing.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

For further information please contact:

Daura Capital Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang

CFO and Secretary

(604) 669-0660

Mark D. Sumner

CEO and Director

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions, and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: risks and uncertainties relating to Daura's ability to complete the proposed Qualifying Transaction; and other risks and uncertainties. In addition, mineralization on adjacent properties may not be indicative of the mineralization found on properties owned by the target of the proposed Qualifying Transaction. Accordingly, actual and future events, conditions, and results may differ materially from the estimates, beliefs, intentions, and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Daura undertakes no obligation to publicly update or revise forward-looking information.

Completion of the transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, majority of the minority shareholder approval. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information released or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

share this

Other Recent Daura Gold News Releases.