News Releases.

Stay informed with the latest news and updates from Daura Gold Corp. (TSXV: DGC)

January 20, 2026

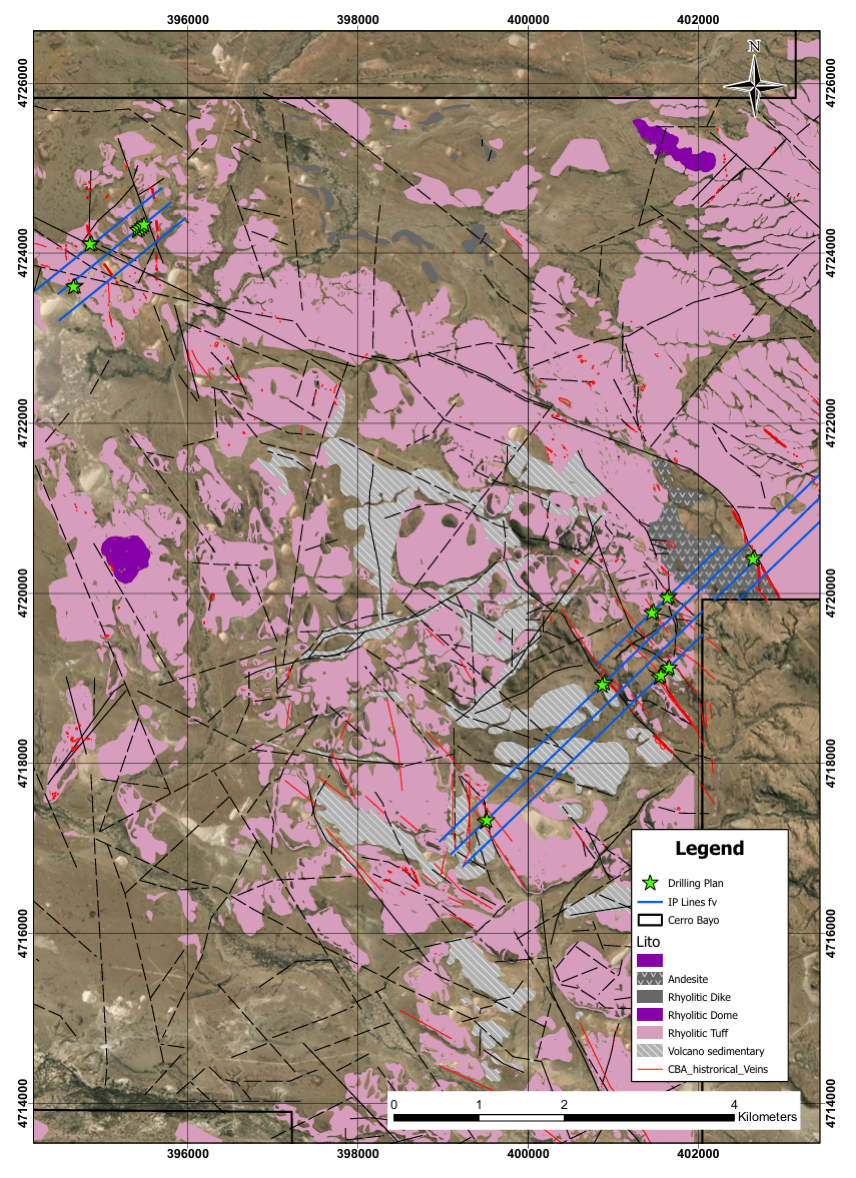

January 20, 2026 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce the successful completion of 27 line-kilometers of Induced Polarization (IP) profiling at the Cerro Bayo Gold–Silver Project (“Cerro Bayo” or the “Project”), located in Santa Cruz Province, Argentina. The completed IP program provides a robust geophysical framework that will be used to define and prioritize drill targets for the Company’s planned Phase 1 drilling program totaling approximately 1,500 meters. Key Project Highlights Include: Completion of seven IP profiles across the project for an aggregated 27 line-kilometers of pole-dipole survey The 7 profiles were sited over previously identified drill target areas to define targets for the Phase 1 drill program, slated to begin in mid-February The IP responses aided in the delineation of structurally controlled zones interpreted to represent silicified veins and mineralizing conduits Mark Sumner, CEO of Daura Gold commented: “The completion of seven Pole–Dipole IP survey lines marks an important milestone for Daura, providing valuable insight into the geometry and extent of potential mineralization across 15 priority targets within both our northern and southern target areas. The results have clearly delineated structurally controlled zones, which we interpret as potential mineralizing conduits and feeder structures. This data will play a key role in refining and prioritizing drill targets ahead of our planned Phase 1 drill program.” Cerro Bayo: Electrical Induced Polarization (IP) Surveys and Preparation for Drilling: A Pole–Dipole IP profiling program has been completed, consisting of four lines in the southeastern area and three additional, shorter lines in the northwestern area, for a total of approximately 27 line-kilometers. 15 drill targets were generated from the integration of previous geochemical sampling and a Previous Gradient Array IP survey covering the southern area of the license area. A Phase 1 program of 22 diamond drill holes for approximately 1,500m aims to test the 15 targets for approximately 1,500m diamond drilling. In the northern target area, three IP profile lines were completed and 8 drill targets have been identified, of which 3 targets will be tested with 8 diamond drill holes for 500m. In the southern area 7 drill targets will be tested with 14 drill holes for 1,000m of diamond drilling.

January 6, 2026

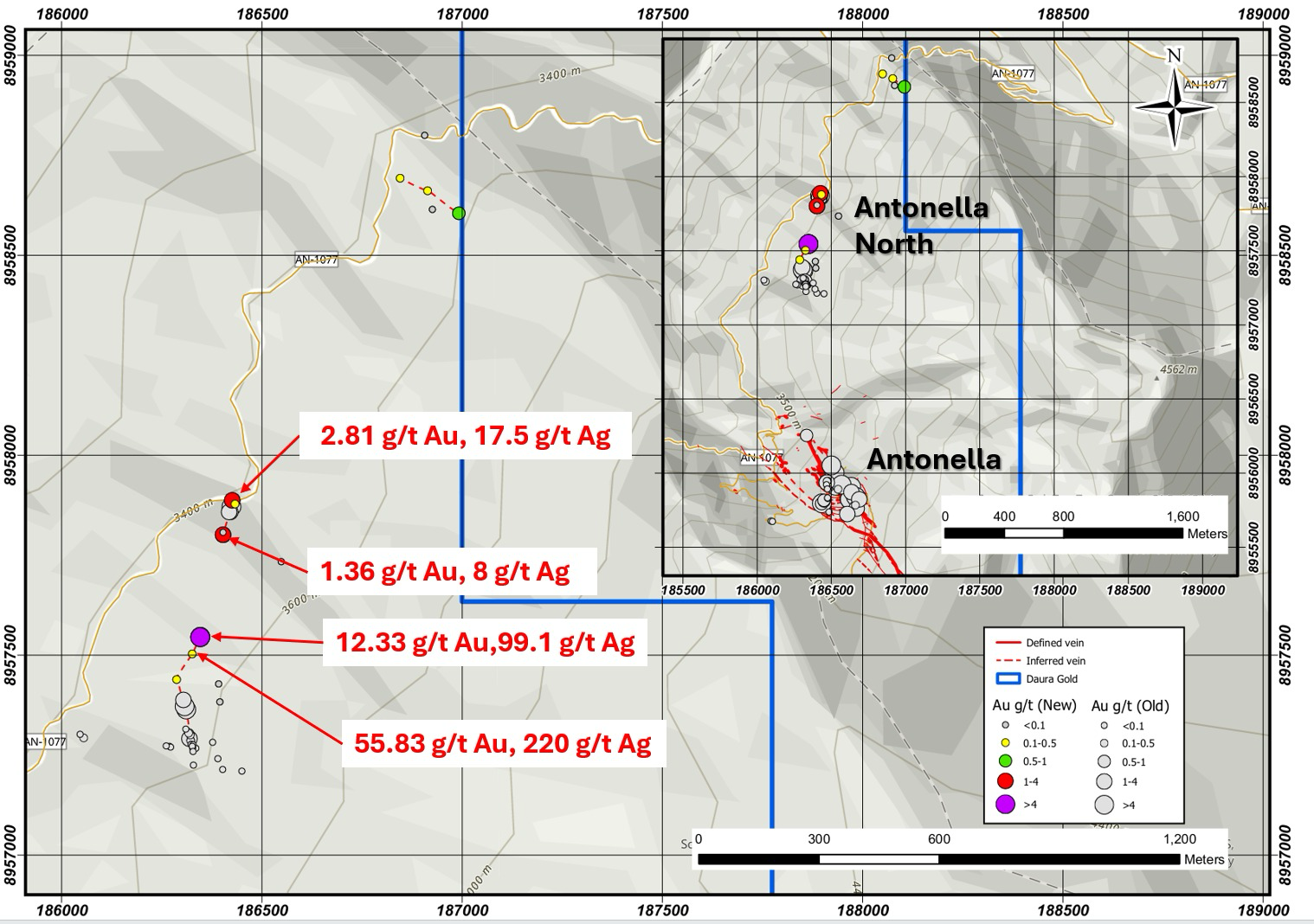

January 6, 2026 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce further high-grade surface sampling results from the previously announced vein extensions in the northern zone of the Company’s flagship Antonella Project (“Antonella” or the “Project”) in Ancash, Peru. Antonella is adjacent to Highlander Silver Corp’s Bonita Project, located in a prolific metallogenic belt hosting significant deposits such as Antamina and Barrick’s past producing Pierina gold mine. The Project’s vein system is hosted in Tertiary volcanic rocks of the Calipuy Group and controlled by NW-SE trending faults, with silicification and argillic alteration halos up to 40 meters wide. “These additional high-grade results from the northern vein extensions at Antonella, build on our recent discoveries and underscore the expanding mineralization footprint of the Antonella Project,” said Mark Sumner, CEO of Daura. “The northern veins at Antonella clearly warrant more attention as we work towards tying these zones together and advance SE towards Highlander’s Bonita project.” Highlights of the Sampling Program: 18 rock chip samples were collected approximately 1km north of the Antonella main zone. Standout samples of 55.83 g/t Au & 220 g/t Ag; and 12.33 g/t Au & 99.1 g/t Ag. Additional high grade gold samples include: 2.81 g/t Au & 17.5 g/t Ag; and 1.36 g/t Au & 8 g/t Ag. Figure 1(below) shows the recent sampling results with respect to previous sampling at Antonella North, together with highlighted sampling from Antonella Main.

December 22, 2025

December 22, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce the commencement of Induced Polarization Electrical Pole - Dipole Profiling and Gradient Array Surveys within the Cerro Bayo gold-silver project located in the prolific Deseado Massif , Santa Cruz Province, Argentina. Key Project Highlights Include: Five priority drill target areas identified by geochemistry, mapping, IP surveys and over 100 line-km of detailed magnetics; Initiation of 27 line-kilometer Pole - Dipole Induced Polarization (IP) Profiling of drill target areas within the Cerro Bayo Property Daura is preparing a Phase 1, 1,500 meter drill program planned for Q1, 2026. Mark Sumner, CEO of Daura Gold commented: "We are very pleased to initiate our geophysical surveys, which will be key to building upon the historical generative exploration on a number of priority drill target areas within the fully permitted zones at Cerro Bayo. This critical step sets the stage for a first phase drilling program in Q1 2026, as we seek to unlock the potential of this high-quality epithermal gold-silver project." Cerro Bayo: Electrical Induced Polarization (IP) Surveys and Preparation for Drilling: A Pole-Dipole IP profiling program has commenced, consisting of four lines in the southeastern area and three additional, shorter lines in the northwestern area, for a total of approximately 27 line-kilometers. The objective of the program is to complete these transects across the five highest-priority drill target areas before the end of the year. The aim of the profiles is to determine the geometry of the silicified zones previously identified from Gradient Array IP surveying. The silicified zones (silica cap) are anomalous in gold, +/- silver and represent the upper parts of a Low Sulphidation Epithermal (LSE) mineralizing system. The presence of silica cap at Cerro Bayo strongly indicates that the LSE system, with its attendant structurally controlled feeder zone, is preserved. Elsewhere within the Deseado Massif, these feeder zones are host to bonanza grade precious metal deposits, e.g. Newmont's Cerro Nego mine. In Q1 2026, Daura will begin regional Gradient Array surveying on a nominal 200m x 25m offset grid, covering an area of 78km2. This work aims to screen the northern part of the licence area for similar resistivity and or chargeability anomalies to those generated by the previous regional Gradient Array Surveying carried out by Barrick Gold in a previous joint venture with Latin Metals. The 'Barrick Gradient' survey successfully defined extensive linear zones of silicification, which when sampled were significantly anomalous in precious metals.

December 3, 2025

December 3, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) announced today that it has granted a total of 3,355,000 incentive stock options to certain of its executive officers, directors and key consultants, in accordance with the Company's stock option plan. Each option is exercisable into one common share of the Company at a price of $0.35 per share, being the closing price of the Company's common shares on the TSX Venture Exchange on December 2, 2025. The options will vest and become exercisable in equal quarterly tranches every 3 months from the grant date, and will expire on December 2, 2030.

December 2, 2025

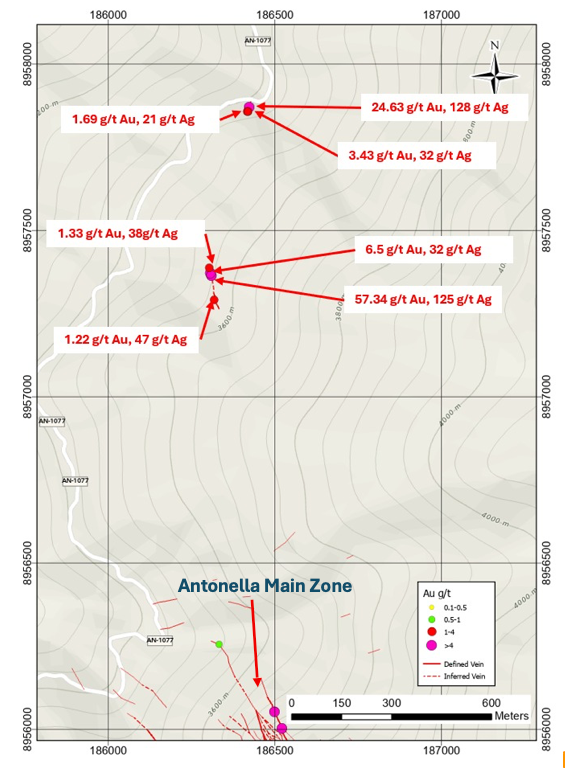

December 2, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce high-grade surface sampling results and the delineation of vein extensions in the northern zone of the Company’s flagship Antonella Project (“Antonella” or the “Project”) in Ancash, Peru. The work confirms strong gold and silver mineralization and supports the continuity of Antonella’s vein system to the north of the main project zone. Antonella is located in a prolific metallogenic belt hosting significant deposits such as Antamina and Barrick’s past producing Pierina gold mine. The Project’s vein system is hosted in tertiary volcanic rocks of the Calipuy Group and controlled by NW-SE trending faults, with silicification and argillic alteration halos up to 40 meters wide. Highlights of the Sampling Program: 31 rock chip samples were collected approximately 1km north of Antonella vein system with mineralization of Au and Ag. Standout samples of 57.34 g/t Au & 125 g/t Ag; and 24.63 g/t Au & 128 g/t Ag. Additional high grade gold samples include: 6.52 g/t Au & 32.6 g/t Ag; 3.47 g/t Au & 32 g/t Ag; and 1.69 g/t Au & 21 g/t Ag. "Assays from Antonella continue to deliver excellent results, as we uncover new zones of high-grade gold and silver mineralization,” said Mark Sumner, CEO of Daura. “This discovery of high-grade gold and silver, north of our main project zone, further confirms the potential at Antonella. We remain excited to advance southeast toward Highlander's Bonita project while simultaneously prioritizing additional work on the highly promising veins identified in the north as exploration progresses."

November 11, 2025

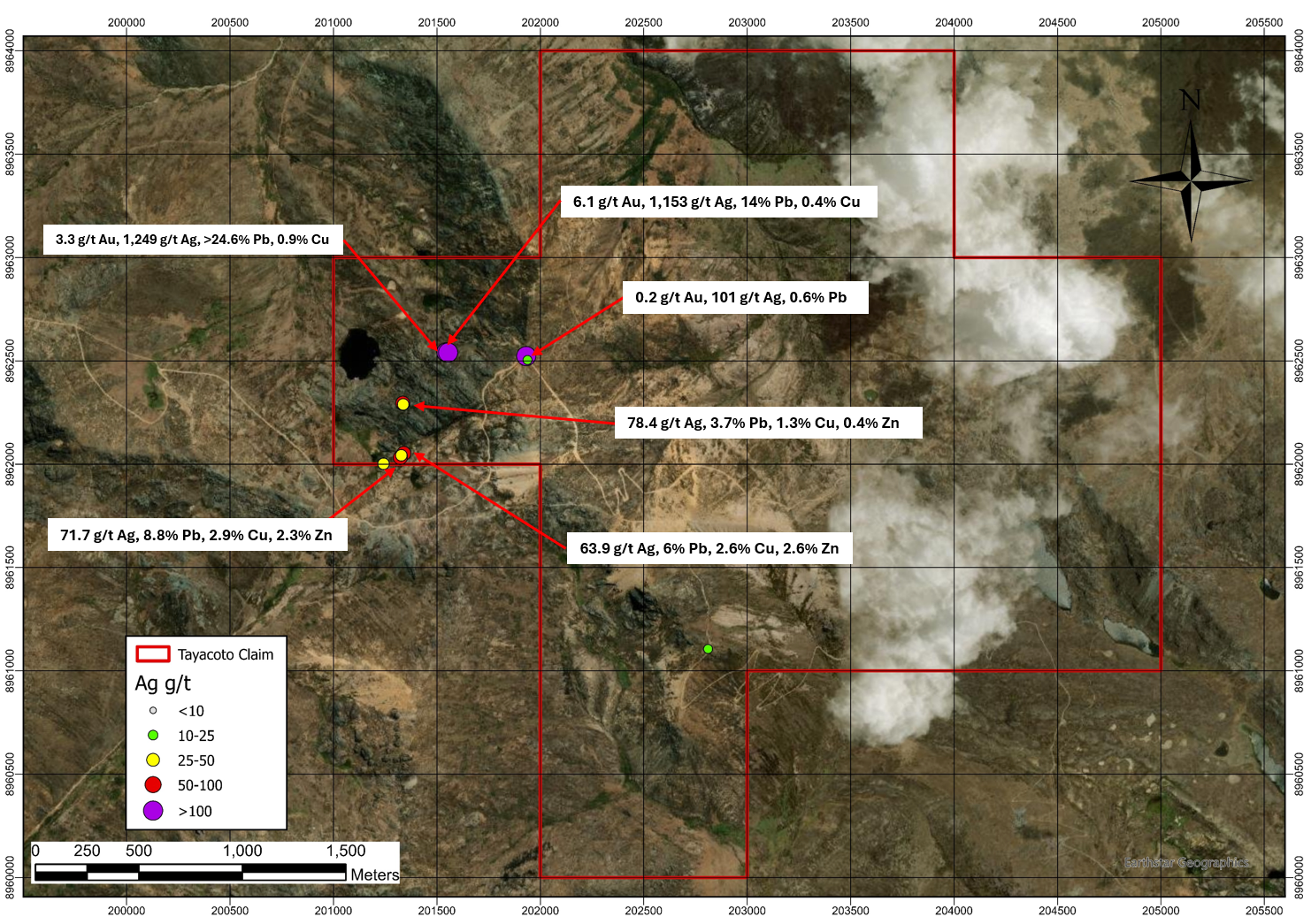

November 11, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce high-grade surface sampling results from its 100% owned Tayacoto Project (“Tayacoto” or the “Project”), located 14.5km northeast of the Company’s flagship Antonella Project in Ancash, Peru. The surface sampling confirms strong precious metal mineralization with associated copper, zinc, and lead, situated approximately 2.5km east of Highlander Silver Corp.’s Daniela project. Tayacoto lies within a prolific metallogenic belt that hosts world-class deposits such as Antamina and Barrick’s past-producing Pierina gold mine. The mineralization at Tayacoto is hosted in Tertiary volcanic rocks of the Calipuy Group and is controlled by NW–SE-trending faults, exhibiting silicification, and argillic alteration. Highlights of the Sampling Program: 22 rock chip samples collected across the project. 8 samples exceeding 45 g/t Ag, with values up to 1,249 g/t Ag. 2 samples showing 6.1 g/t Au, and 3.3 g/t Au. Copper values as high as 2.9% Cu. Standout samples include: 6.1 g/t Au, 1,153 g/t Ag, 0.4% Cu, >14% Pb; 3.3 g/t Au, 1,249g/t Ag; 0.9% Cu, >24.6% Pb; 0.2 g/t Au, 101 g/t Ag, 0.6% Pb. 63.9 g/t Ag, 2.6% Cu, 6% Pb; 2.6% Zn; 71.7 g/t Ag, 2.9% Cu, 8.8% Pb, 2.3% Zn; 78.4 g/t Ag, 1.3% Cu, 3.7% Pb, 0.4% Zn; and 101 g/t Ag, 0.6% Pb, 01% Zn The mineralization at the Tayacoto Project is related to an epithermal vein system, with vein widths ranging from 0.2 m to 1 m. The veins show iron oxides forming gossan in some areas, while in others, there are zones of argillic alteration and silicification. The surface sampling confirms strong precious metal mineralization with associated copper, zinc and lead. “The results from Tayacoto reinforce the strength of Daura’s exploration portfolio and highlight the discovery potential in this district,” said Mark Sumner, CEO of Daura. “The high grades showing at surface at Tayacoto immediately raise the profile of this project for Daura. Situated only 14.5km from our flagship Antonella project, Tayacoto represents another opportunity for Daura to create significant value through disciplined and systematic exploration in one of the most exciting gold-silver districts in Peru.”

November 5, 2025

November 5, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce the recent transition of Mr. Mark Sumner to Chief Executive Officer, effective November 1, 2025. Mr. Sumner, formerly President and Director, will assume responsibility for the Company’s day-to-day operations and strategic direction as it enters a new phase of exploration and growth. Luis (“Lucho”) Saenz, Daura’s current CEO, will remain on the Board of Directors and continue to play a critical role in Peru, supporting advancement of the Company’s flagship Antonella–Libélulas Project and broader regional activities. “Formalizing Mark’s transition to CEO comes at an exciting time for Daura,” said Luis Saenz, Director. “His leadership has been central to the Company’s evolution from inception to an emerging exploration story with exceptional growth potential. I look forward to continuing to contribute on the ground as we advance the flagship Antonella–Libélulas Projects in Peru.” “I’m honoured to lead Daura into its next phase of development,” said Mark Sumner, incoming CEO of Daura Gold. “With a strong treasury, an experienced technical team, and a clear focus on high-impact exploration, Daura is well positioned to deliver meaningful results and create long-term value for shareholders.” Finders’ Fee Update On October 9, 2025 the Company closed its non-brokered private placement (the “Offering”) and issued 28,000,000 units (each, a “Unit”) at a price of $0.25 per Unit for gross proceeds of $7,000,000. Each Unit consists of one common share in the capital of the Company (each, a “Share”) and one-half-of-one Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to purchase one additional Share at a price of $0.375 until October 9, 2027. In connection with completion of the Offering, the Company paid finders’ fees of $218,277.50 and issued 1,726,970 non-transferable share purchase warrants (each, a “Finders’ Warrant”) and 853,860 units (each, a “Finders’ Unit”) to certain arms-length third-parties who assisted in introducing subscribers. The number of Finders’ Warrants and Finders’ Units issued were incorrectly reported in the news release issued by the Company on October 9, 2025. Each Finders’ Warrant is exercisable on the same terms as the Warrants. Each Finders’ Unit consists of one Share and one-half-of-one Finders’ Warrant. All securities issued in the Offering are subject to a statutory hold period until February 10, 2026, in accordance with applicable Canadian securities laws.

November 3, 2025

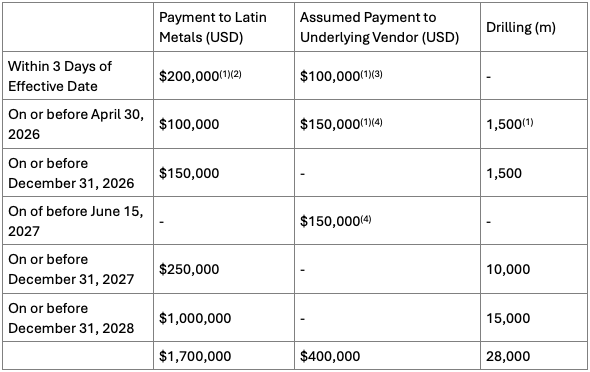

November 3, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce it has entered into a binding letter agreement (the “Agreement” ) with Latin Metals Inc. (TSXV: LMS)(OTCQB: LMSQF) (“Latin Metals”) , an arms-length party, granting Daura the right to earn up to an 80% interest in the Cerro Bayo and La Flora gold-silver projects (together, the “Projects” ) located in the prolific Deseado Massif, Santa Cruz Province, Argentina. Mark Sumner, President of Daura Gold commented: “As Daura continues to advance its flagship Antonella Project in Peru, this agreement provides the Company with excellent optionality on a high-quality, drill ready target in the Deseado Massif, which is one of the world’s most prolific gold and silver districts. This agreement directly aligns with Daura’s strategy of targeting and advancing high-grade epithermal gold and silver systems in proven mineral belts, complementing the Company’s exciting projects in Peru.” Cerro Bayo & La Flora: High-Grade Gold-Silver Potential in the Deseado Massif The Cerro Bayo and La Flora Project lie in the heart of Argentina’s premier gold-silver district, the Deseado Massif, which has yielded more than 600 million ounces of silver and 20 million ounces of gold since 1990 (1) . The district hosts world-class operations such as Newmont’s Cerro Negro Mine (~7 Moz AuEq 2 ) and Hochschild’s San Jose Mine (~64 Moz AgEq 3 ). Exploration to date at Cerro Bayo has defined a 6-kilometre-wide structural corridor with multiple low-sulfidation epithermal-style vein target areas — the same style responsible for the region’s highest-grade precious metal deposits. Key technical highlights include: Nine high-priority drill target areas identified by geochemistry, mapping, IP surveys and over 100 line-km of detailed magnetics; Surface Samples at La Flora have returned up to 71 g/t Au and 150 g/t Ag, and 82 g/t Au and 1,239 g/t Ag. And 2.3 g/t Au and 600 g/t Ag at Cerro Bayo. Drill ready with 21 fully permitted drill pads, following Environmental Impact Assessment (EIA) approval received in early 2025; Year-round access and strong infrastructure supporting a rapid exploration start-up; Geological and alteration characteristics consistent with known high-grade gold-silver systems in the Deseado Massif. Option Terms Daura will be granted the option (the “ Option ”) to earn a 75% undivided interest in the Projects for a period (the “ Option Period ”) of 38 months from the date of execution and delivery (the “ Effective Date ”) of the Letter Agreement. To exercise the Option, Daura must make aggregate payments of US $1,700,000 to Latin Metals, assume payments of US $400,000 to the Underlying Vendor (as defined below), complete exploration work commitments, and prepare and deliver to Latin Metals a report prepared in accordance with Form 43-101F1 on the Properties (the “ Technical Report ”), addressed to Latin Metals and containing a mineral resource estimate on the Projects. Irrevocable work commitments to be completed on or before April 30, 2026, are 50-line km of IP profiling, 150-line km of gradient array IP, and 1,500 meters of drilling. A total of 28,000m of drilling must be completed prior to the exercise of the Option. The Projects are currently subject to an underlying purchase agreement (see news release dated June 25, 2025) between Latin Metals and Tres Cerros Exploraciones S.R.L. (the “ Underlying Vendor ”). The Underlying Vendor retains a 0.75% NSR royalty, 0.5% of which can be purchased for US $1,000,000, which cost will be assumed by Daura. Top Up Right Concurrently with the exercise of the Option, Daura may give notice to Latin Metals of its intention to increase its interest in the Projects to 80% (the “ Top-Up Right ”). To exercise the Top-Up Right, Daura must make cash payments to Latin Metals based on the measured, indicated and inferred mineral resources included in the mineral resource estimate set out in the Technical Report, as follows: US$7.00 per gold equivalent ounce of measured and indicated resources; and US$5.00 per gold equivalent ounce of inferred resources, Table 1: Option Terms

October 14, 2025

October 14, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce the appointment of Mr. Stuart Mills, M.Sc., as Vice President of Exploration. Mr. Mills brings over 30 years of global expertise in mineral exploration, feasibility-stage projects, and M&A, with key roles in multiple multi-million-ounce gold discoveries across Africa, the Middle East, and Europe. He has held senior technical and management positions with leading firms, including Anglo American, Lundin Mining, and Red Back Mining. At Anglo American, he served in senior geological roles across Turkey, Yemen, Iran, and Eastern Europe. As Country Manager in Ireland, he led the discovery of the Bog Zone satellite orebody to Anglo’s Lisheen zinc-lead mine. As Principal Geologist for Asia-Pacific, he oversaw a significant zinc-lead discovery in Australia’s Northern Territory and managed exploration in China and India. At Lundin Mining, as Regional Exploration Manager for Africa-Eurasia, he provided technical oversight for major investments, including the Ozernoe Zn-Pb Feasibility Study in Russia and the Tenke Fungurume copper-cobalt project in the DRC, while contributing to M&A initiatives from Peru to Eritrea. At Red Back Mining, he held senior roles in project generation, M&A, and exploration management prior to its acquisition by Kinross Gold. He then collaborated with Red Back’s executive team on new ventures, including leadership at Sirocco Mining, where he was instrumental in discovering the Morondo gold deposit in Côte d’Ivoire (now Montage Gold’s Kone Project). As Country Manager in Sudan, he led the discovery of Galat Sufar South (now Perseus Mining’s Meyas Sand Project). “We are delighted to welcome Stuart to the Daura Gold leadership team,” said Mark Sumner, President of Daura Gold. “His discovery record and depth of technical expertise will be invaluable as we continue advancing exploration at our Antonella and Bonita Projects in southern Peru and evaluate new growth opportunities across the region.” “Daura Gold is positioned in one of the most exciting gold-silver belts in the Andes, and I’m eager to contribute to expanding its resource potential,” said Stuart Mills. “With a strong technical team and supportive board, we have all the right elements to deliver meaningful results.” Mr. Mills holds a Master of Science in Mineral Exploration and Mining Geology and is a Professional Geologist with extensive international experience in both greenfield and brownfield settings.

October 9, 2025

October 9, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura” ) is pleased to announce it has closed its upsized and oversubscribed private placement of 28,000,000 units of the Company (the “ Units ”) at a price of $0.25 per Unit for gross proceeds of $7,000,000 (the “ Offering ”). Each Unit consists of one common share of the Company and one-half-of-one share purchase warrant (each whole warrant, a “ Warrant ”). Each Warrant entitles the holder to acquire an additional common share of the Company at a price of $0.375 until October 9, 2027. The Company expects to utilize the proceeds of the Offering for advancement of its exploration land package in the Ancash Department of Peru, including the Company’s flagship Antonella project and the Yanamina Project 40km, north of Antonella, and for general working capital purposes. “We’re very pleased to have completed this upsized, oversubscribed $7 million private placement,” stated Mark Sumner, President of Daura. “Investor participation exceeded expectations and we’re very grateful for the market’s confidence in Daura’s vision and project pipeline. With this financing now complete, we’re moving forward with our exploration and community initiatives across our projects.” In connection with completion of the Offering, the Company paid finders’ fees of $218,277.50, and issued 1,782,970 finders’ warrants and 909,860 finders’ units to eligible third-parties who introduced subscribers to the Offering. The finders’ warrants are exercisable on the same terms as the Warrants, and the finders’ units consist of the same securities as the Units. All securities issued in connection with the Offering are subject to restrictions on resale until February 10, 2026 in accordance with applicable securities laws.

Stay Updated With Daura Gold.

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Sign up for our newsletter to receive news releases and exclusive company updates.