December 22, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura”) is pleased to announce the commencement of Induced Polarization Electrical Pole - Dipole Profiling and Gradient Array Surveys within the Cerro Bayo gold-silver project located in the prolific Deseado Massif, Santa Cruz Province, Argentina.

Key Project Highlights Include:

- Five priority drill target areas identified by geochemistry, mapping, IP surveys and over 100 line-km of detailed magnetics;

- Initiation of 27 line-kilometer Pole - Dipole Induced Polarization (IP) Profiling of drill target areas within the Cerro Bayo Property

- Daura is preparing a Phase 1, 1,500 meter drill program planned for Q1, 2026.

Mark Sumner, CEO of Daura Gold commented: "We are very pleased to initiate our geophysical surveys, which will be key to building upon the historical generative exploration on a number of priority drill target areas within the fully permitted zones at Cerro Bayo. This critical step sets the stage for a first phase drilling program in Q1 2026, as we seek to unlock the potential of this high-quality epithermal gold-silver project."

Cerro Bayo: Electrical Induced Polarization (IP) Surveys and Preparation for Drilling:

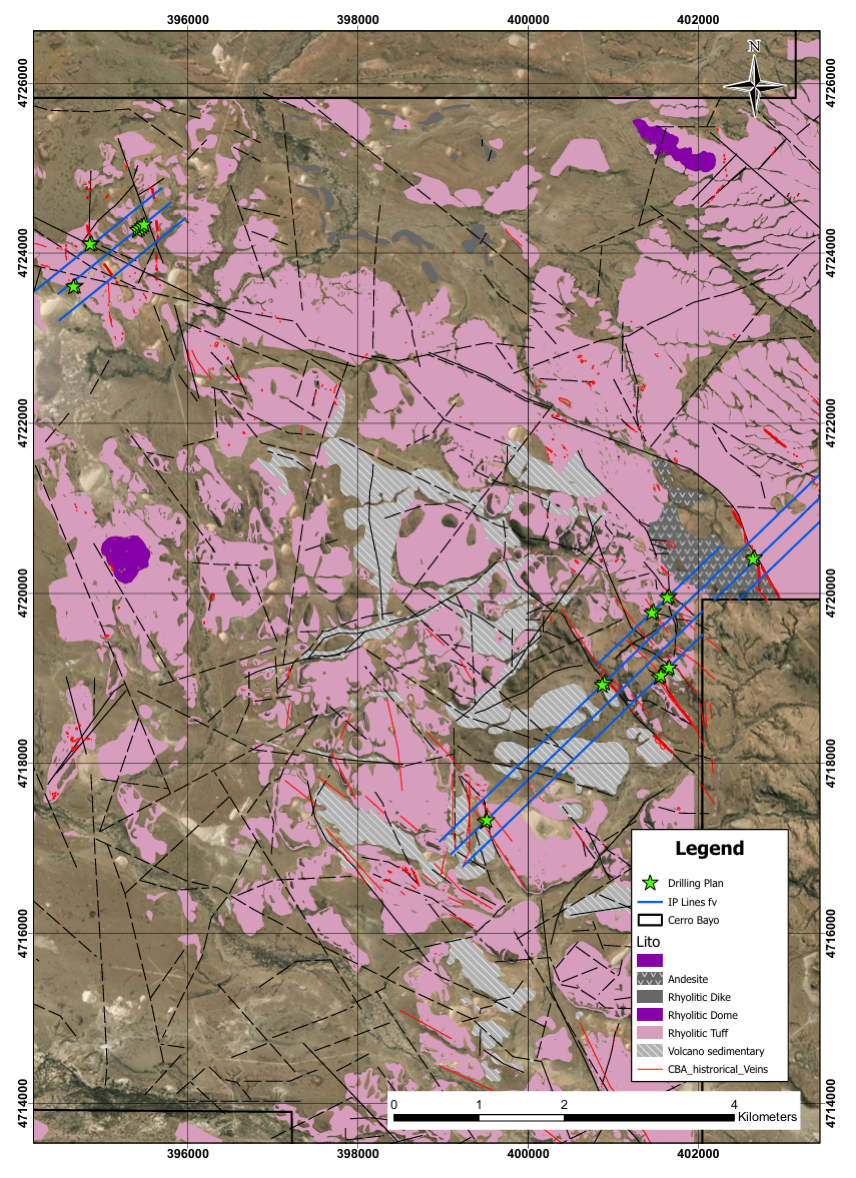

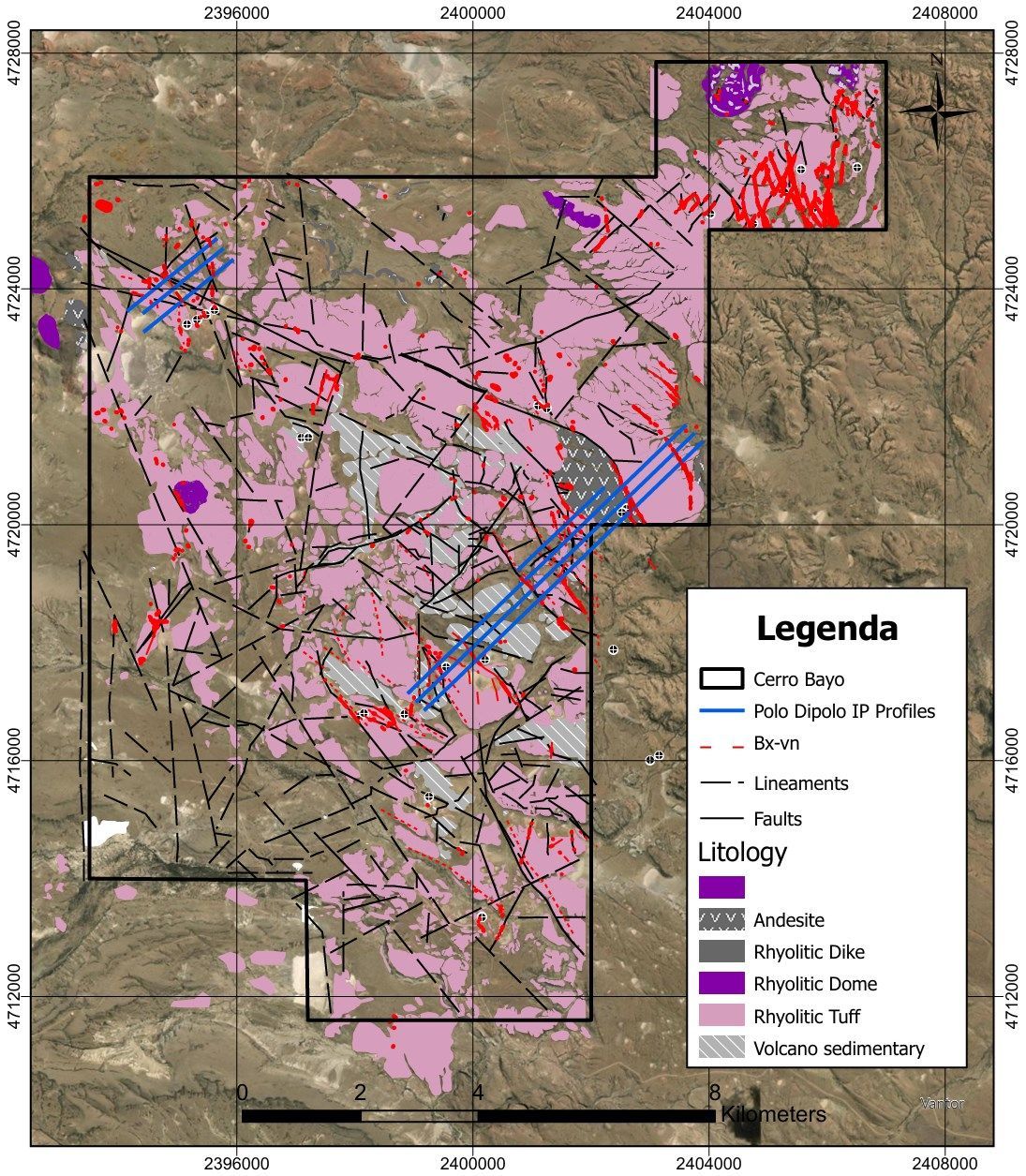

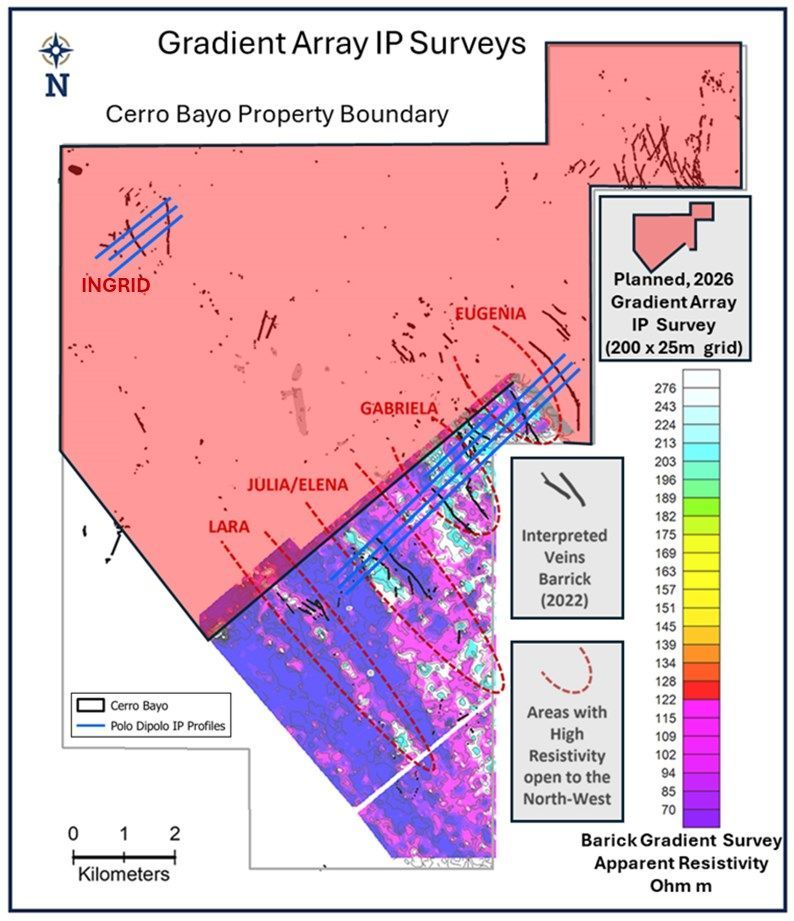

A Pole-Dipole IP profiling program has commenced, consisting of four lines in the southeastern area and three additional, shorter lines in the northwestern area, for a total of approximately 27 line-kilometers. The objective of the program is to complete these transects across the five highest-priority drill target areas before the end of the year. The aim of the profiles is to determine the geometry of the silicified zones previously identified from Gradient Array IP surveying. The silicified zones (silica cap) are anomalous in gold, +/- silver and represent the upper parts of a Low Sulphidation Epithermal (LSE) mineralizing system. The presence of silica cap at Cerro Bayo strongly indicates that the LSE system, with its attendant structurally controlled feeder zone, is preserved. Elsewhere within the Deseado Massif, these feeder zones are host to bonanza grade precious metal deposits, e.g. Newmont's Cerro Nego mine.

In Q1 2026, Daura will begin regional Gradient Array surveying on a nominal 200m x 25m offset grid, covering an area of 78km2. This work aims to screen the northern part of the licence area for similar resistivity and or chargeability anomalies to those generated by the previous regional Gradient Array Surveying carried out by Barrick Gold in a previous joint venture with Latin Metals. The 'Barrick Gradient' survey successfully defined extensive linear zones of silicification, which when sampled were significantly anomalous in precious metals.

About Cerro Bayo and La Flora

Exploration work completed to date, including geochemical sampling, detailed mapping, and over 100 line-km of magnetic surveys, has defined a 6 km-wide structural corridor with multiple low-sulfidation epithermal-style vein target areas.

In March 2025, Latin Metals received formal approval of the Environmental Impact Assessment (EIA), authorizing exploration drilling at Cerro Bayo. The approved permit includes authorization for up to 21 drill pads across the project area, defined by historical and recent exploration.

Option Payment

The Company currently holds an option (the "Option") to acquire an interest in the Cerro Bayo gold-silver project from Latin Metals Inc. ("LMS"), an arms-length party. In order to exercise the Option, the Company is required to complete a series of payments and exploration work. Initially, the Company is required to make a payment (the "Initial Payment") of US$200,000 to LMS, which can be paid in cash or satisfied in common shares of the Company, at the election of the Company.

The Company has notified LMS that it has elected to satisfy the Initial Payment through the issuance of common shares (the "Payment Shares"). The Payment Shares are issuable at a deemed priced equivalent to the greater of the twenty-day volume-weighted average price of the shares on the TSX Venture Exchange (C$0.37) and the market price of the shares on the TSX Venture Exchange as of the date of announcement of the Option (C$0.30). The Company has determined that a total of 744,992 Payment Shares will be issuable to LMS to satisfy the payment at a deemed price of C$0.0.37 per Payment Share.

Completion of the issuance of the Payment Shares remains subject to the approval of the TSX Venture Exchange. In addition to resale restrictions prescribed by applicable securities laws, LMS will be restricted from transferring the Payment Shares for a period of twelve months.

For further information regarding the terms of the Option, readers should review the news release issued by the Company on November 3, 2025.

Qualified Person

Stuart Mills QP, is the Company's qualified person as defined by NI 43-101 and has reviewed and approved the scientific and technical information contained in this news release. Mr. Mills is not independent of the Company, as he is the Company's Vice President of Exploration.

Readers are cautioned that the mineral deposits discussed above are adjacent properties and that Daura has no interest in or right to acquire any interest in the deposits, and that mineral deposits on adjacent or similar properties, and any production therefore or economics with respect thereto, are not in any way indicative of mineral deposits on the Cerro Bayo property or the potential production from, or cost or economics of, any future mining of any of Daura's mineral properties.

About Daura Gold Corp.

Listed on the TSX Venture Exchange, Daura is is exploring in Peru and Argentina.

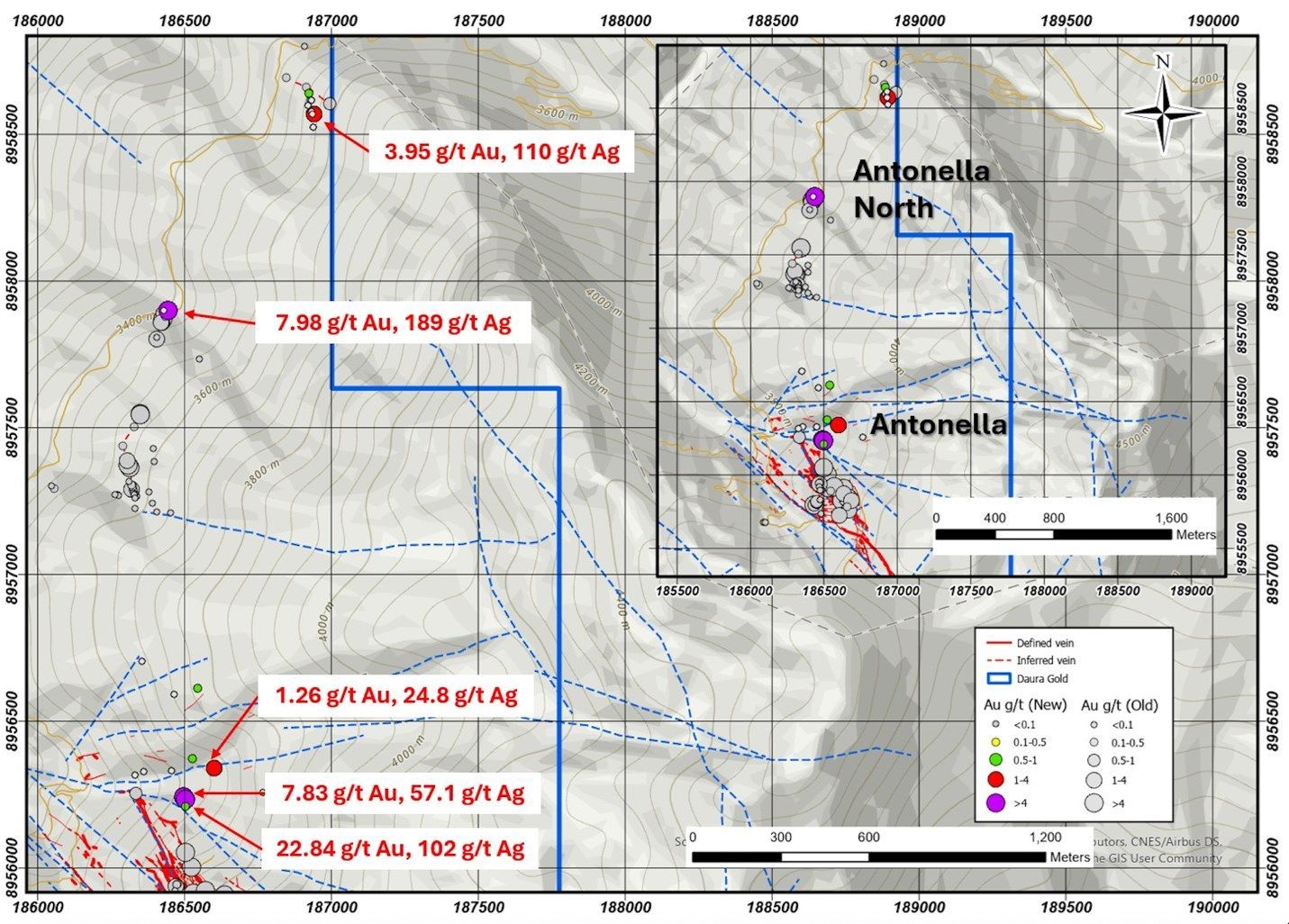

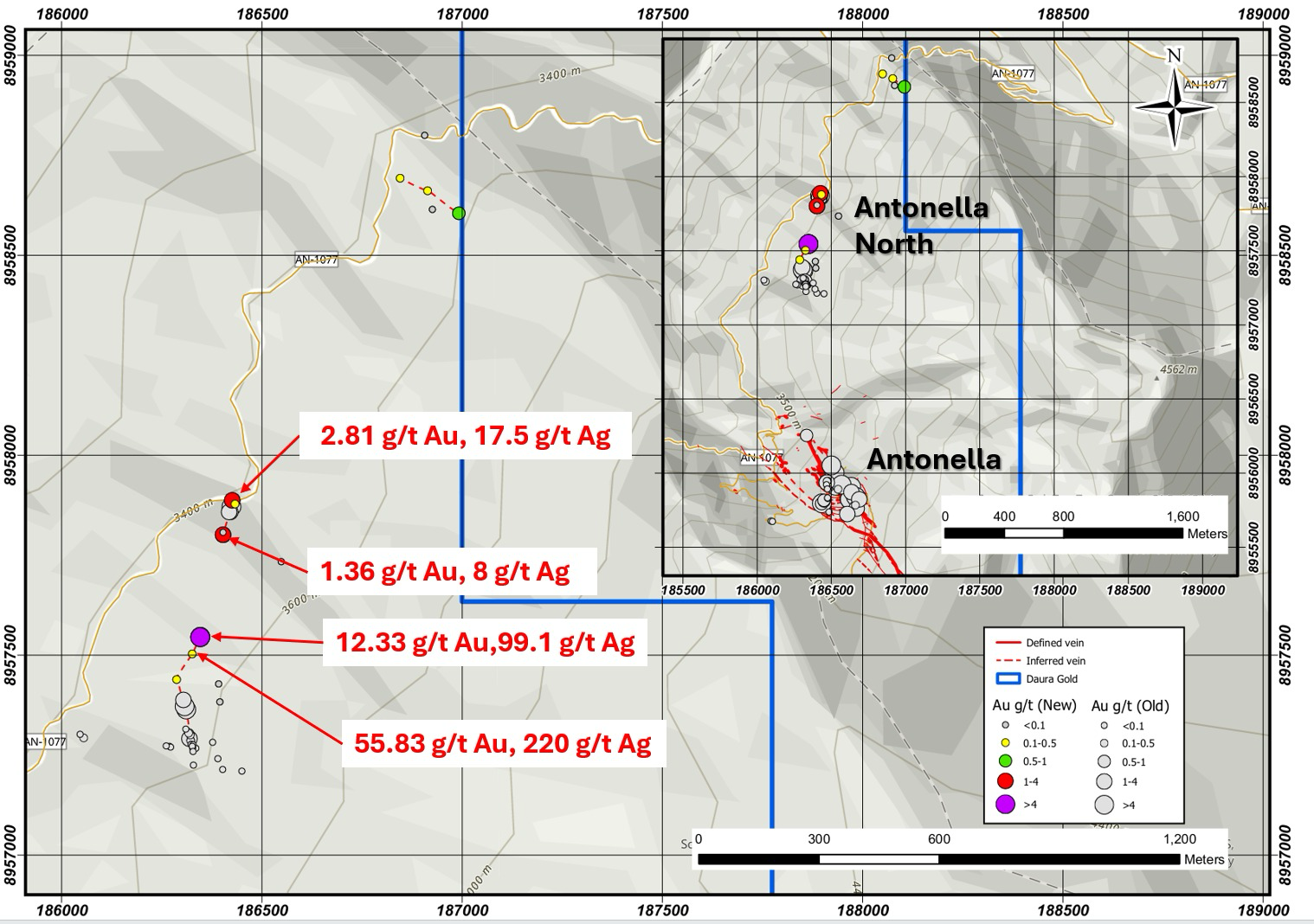

In Peru, Daura is advancing high-impact exploration projects in Peru's renowned Ancash region, where it owns a 100% undivided interest in over 15,900 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target and the 2,900-hectares of contiguous concessions at Libelulas, which is the primary focus of Daura's current exploration efforts.

In Argentina, Daura have entered into a binding Letter Agreement with Latin Metals Inc., for the right to earn up to an 80 % interest in the Cerro Bayo / La Flora Project. The project is located within the prolific Deseado Massif that hosts more than 30 mines and advanced exploration projects, including Newmont's Cerro Negro Mine, Hochschild/McEwen's San Jose Mine, and Patagonia Gold's Cap Oeste Mine. Cerro Bayo / La Flora are advantageously positioned within this world-class mining region, with strong community support and well-developed logistics.

For further information please contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

Cautionary Statement Regarding Forward Looking Information:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

share this

Other Recent Daura Gold News Releases.