Daura Gold Investor Overview.

Unlocking High-Grade Gold Potential in Peru's Historic Mining Region of Ancash.

Daura Gold Corp.

Why Invest ?

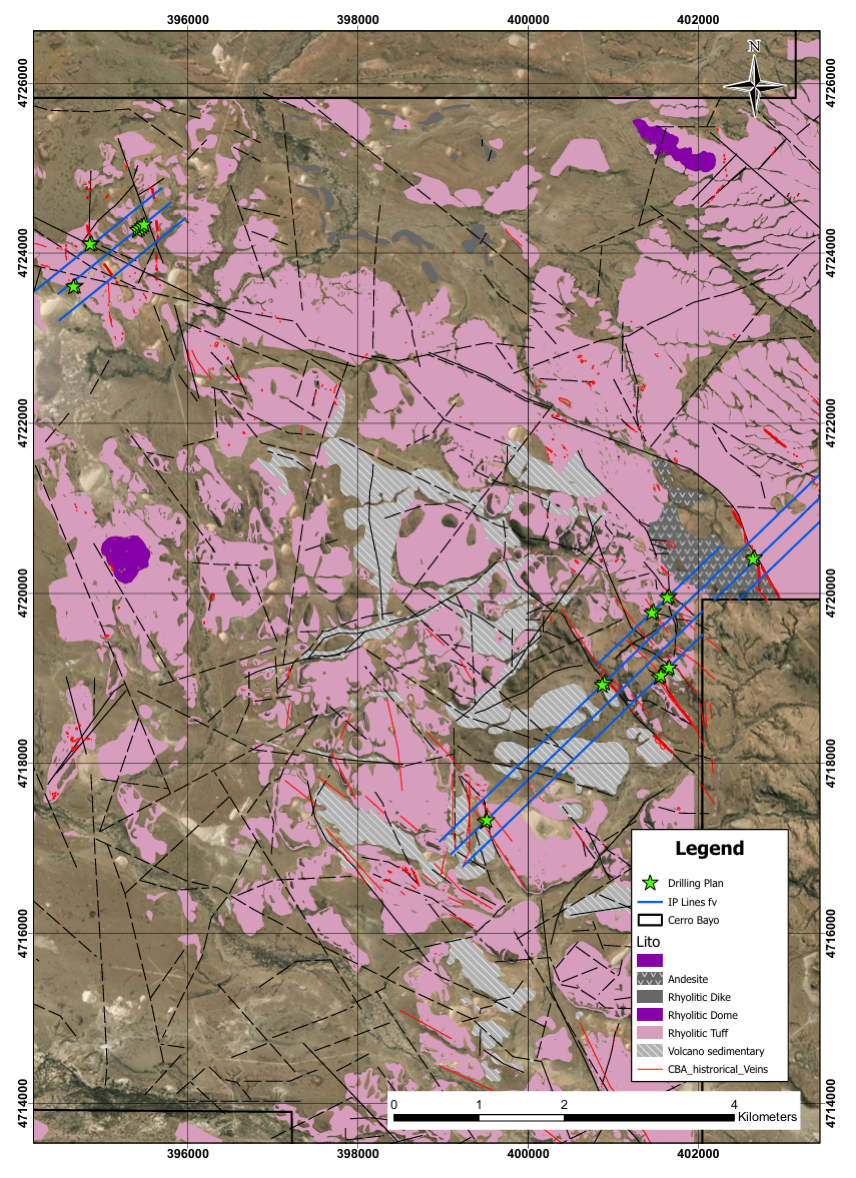

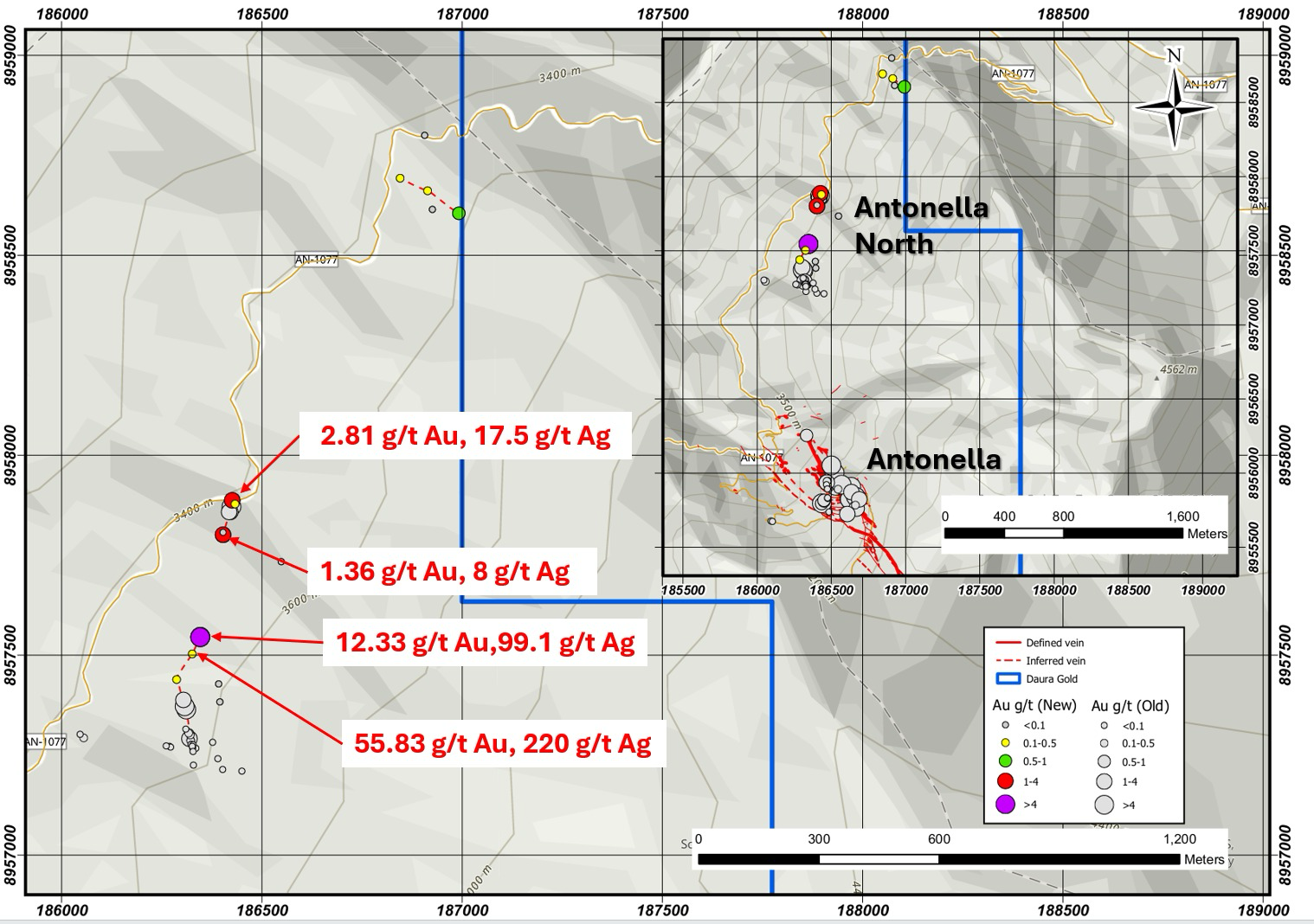

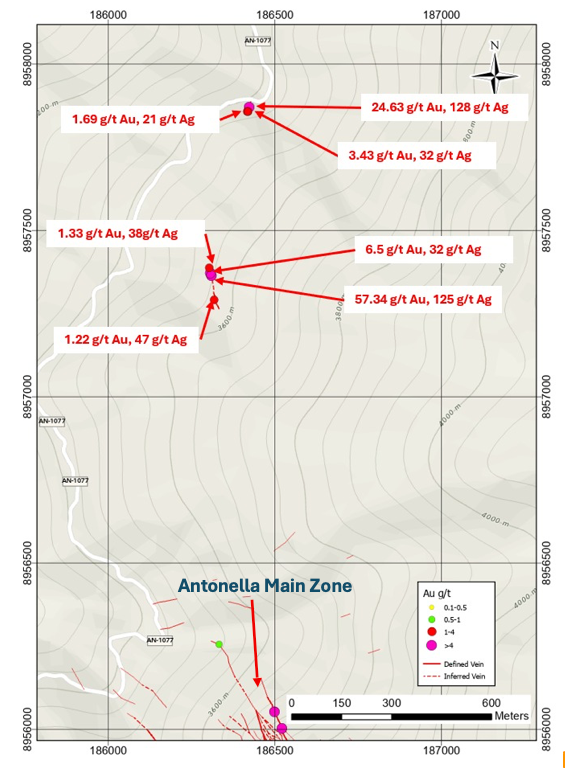

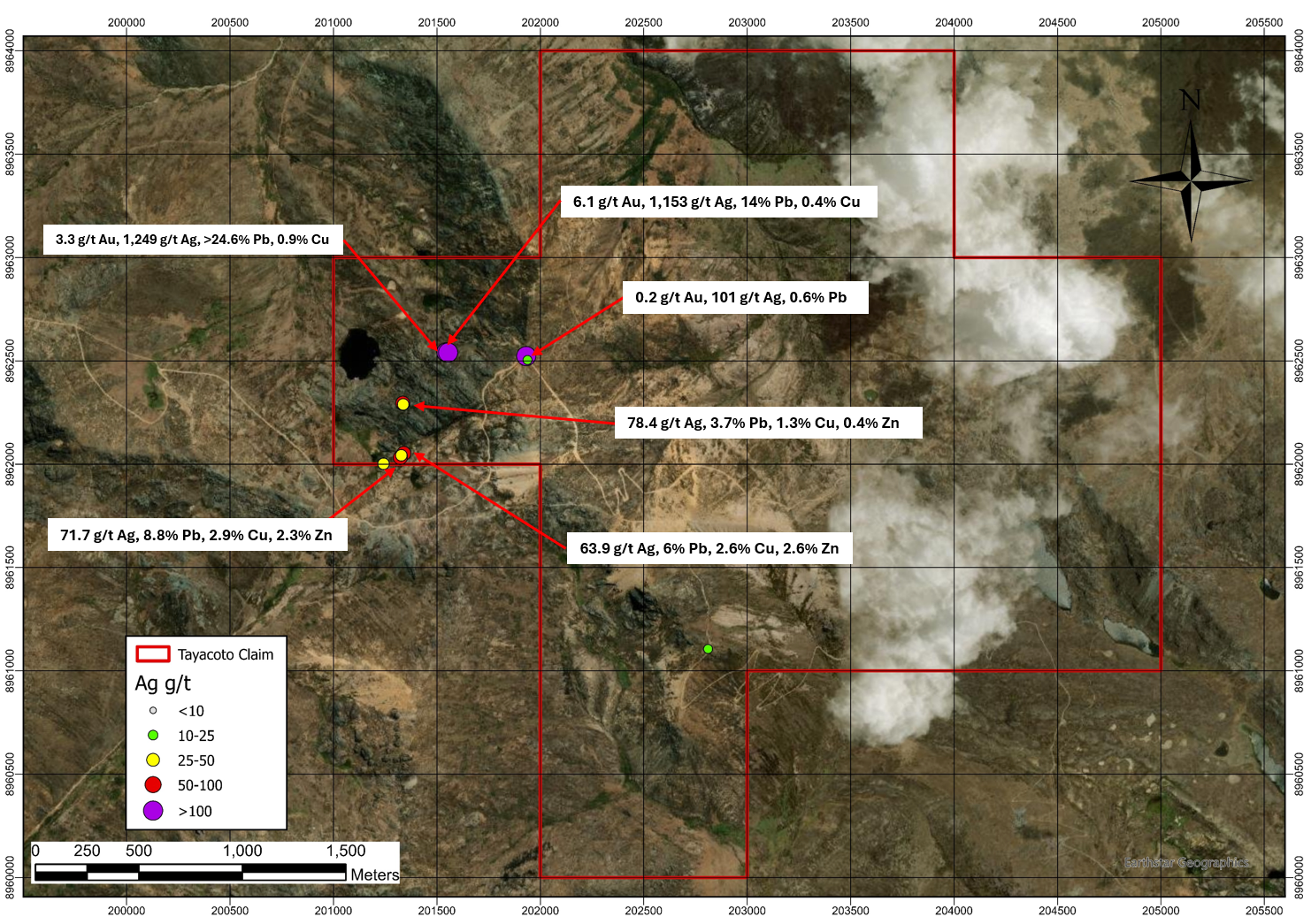

Daura Gold (TSXV: DGC) is building a district-scale position in Peru’s Ancash region focused on high-grade epithermal gold–silver. Our 15,900+ ha land package spans the San Luis–Bonita corridor (Antonella & Libélulas) and Yanamina, where a historic (non-current) gold resource provides a platform for verification and growth. We pair disciplined geology with community-first execution and clear, near-term catalysts.

Daura Gold Corp. is at the forefront of gold exploration in the renowned Ancash region of Peru, home to some of the highest-grade gold deposits in the world. Our strategic acquisition of Estrella Gold SAC positions us with a substantial land package in this historic district.

Investment Highlights.

~8,100 hectares of exploration concessions in the Ancash Province, a known high-grade precious metals district.

Extensive land package

900 hectare area of mineralized veins of the old Esperanza mine directly adjacent to Highlander Silver's La Bonita Target.

The Antonella Target

Including Newmont (Yanacocha, South America’s largest gold mine), Hochschild Mining, Barrick and Highlander Silver.

Adjacent Signicant Projects

Previously drilled 2,461 metres, 11 diamond drill holes, all holes intercepted veining and mineralized intervals.

Innovation Driven.

Download Our Corporate Presentation.

Get an in-depth look at Daura Gold's corporate strategy, industry expertise, and project details. Download our corporate presentation to discover the driving forces behind this emerging high-grade precious metals explorer.

TSXV: DGC

TSXV: DGC

| 77,546,717 | 3,775,000 | 37,282,602 | 118,604,319 |

|---|---|---|---|

| Shares Outstanding | Options | Warrants | Fully Diluted |

| @ ~$0.15/share | @$0.10 & $0.375/share |

Media.

See the latest media mentions and appearances for Daura

Resource Stock Digest

Dec 3, 2025

Resource Stock Digest

Nov 12, 2025

Making Money Matter

Oct 30, 2025

Resource Stock Digest

Sep 18, 2025

TokStocks

Aug 11, 2025

News and Updates.

Get the latest news and updates from the Daura Gold (TSXV: DGC)

Transfer Agent

Computershare

510 Burrard St., 3rd Floor

Vancouver, BC, Canada V6C 3B9

+1 (604) 661-9460

Auditor

Davidson & Company

1200-609 Granville Street

Vancouver, BC, Canada V7Y 1G6

+1 (604) 687-0947

Legal

O’Neill Law LLP

Suite 704 - 595 Howe Street

Vancouver, BC V6C 2T5

604-687-5792 ext. 201

Financials.

AGM Materials.

The Annual General Meeting of Shareholders will be held on Wednesday, December 17, 2025

FAQs.

Find answers to common questions about Daura Gold.

What is Daura Gold Corp.?

Daura Gold Corp is a publicly traded exploration company focused on discovering and developing high-grade gold deposits in Peru's Ancash region. With a strategic land package adjacent to major mining projects and a seasoned management team, Daura is committed to unlocking significant value in one of the world’s most promising gold districts. The company is listed on the TSX Venture Exchange under the ticker DGC.

What is the company’s exploration focus?

Daura Gold Corp is focused on exploring and developing high-grade gold deposits in Peru’s Ancash region, particularly our flagship Antonella target, which is adjacent to Highlander Silver’s Bonanza-grade La Bonita project.

How is Daura Gold Corp funded?

Daura Gold Corp. has been funded through equity financing, including recent capital raises through the issuance of shares and warrants.

As the Company is an explorer and not generating revenues from active mining operations, shareholders should expect further dilution through future financings needed to advance the Company's projects.

Who are the key members of Daura Gold Corp’s management team?

Our management team includes CEO Luis Saenz, CFO Bill Tsang, and several experienced directors with extensive backgrounds in mining, exploration, and finance. Detailed bios are available on the About Us page.

Where can I find Daura Gold Corp’s financial reports?

Our financial reports, including quarterly and annual filings, can be found in the Financials section of our Investor Overview page or through the SEDAR website.

What stock market does Daura Gold Corp trade on?

Daura Gold Corp is listed on the TSX Venture Exchange under the ticker symbol DGC.

What is the share structure of Daura Gold Corp?

As of October 17, 2025 the company has:

• 77,546,717 Shares Outstanding

• 3,775,000 Incentive Stock Options

• 37,282,602 Warrants

• 118,604,319 Shares Fully Diluted

I'm having some difficulty transferring my shares. Who can I talk with?

For assistance with transferring shares, please contact the company's transfer agent:

Computershare

510 Burrard St., 3rd Floor, Vancouver, British Columbia, V6C 3B9

Tel: 1-800-564-6253

Or https://www-us.computershare.com/Investor/Contact/Enquiry

Or via their virtual chat service: Ask Penny

How can I stay updated with Daura Gold Corp's news and developments?

News ReleasesYou can stay updated by subscribing to our email alerts through our website, following our official social media channels, and regularly checking the News Releases section of our Investor Overview page.

How do I contact Investor Relations?

You can reach our Investor Relations team by email at investors@dauragold.com or by phone at +1 (604) 669-0660. We are here to answer any questions you may have.

Stay Updated With Daura Gold.

We will get back to you as soon as possible.

Please try again later.

Sign up for our newsletter to receive news releases and exclusive company updates.