Vancouver, British Columbia — (May 14, 2024) – Daura Capital Corp. (TSXV:DUR.P) (the “Company” or “Daura”), a capital pool company under the policies of the TSX Venture Exchange (the “TSXV”), is pleased to announce a non-brokered private placement to be completed concurrent with the Company’s previously announced proposed Qualifying Transaction (the “Concurrent Financing”). The Qualifying Transaction involves the acquisition of Estrella Gold S.A.C. (“Estrella”), as detailed in the Company’s news release dated May 6, 2024.

Concurrent Financing

Pursuant to the Concurrent Financing, the Company intends to issue a minimum of 16,666,667 units (each a “Unit”) and a maximum of up to 25,000,000 Units at a price of $0.06 per Unit for gross proceeds of between $1,000,000 and $1,500,000. Each Unit will consist of one common share in the capital of the Company (a "Daura Share") and one (full) share purchase warrant (each a “Warrant”). Each Warrant will entitle the holder to purchase one additional Daura Share at a price of $0.10 per share for a period of two years from the date of issuance.

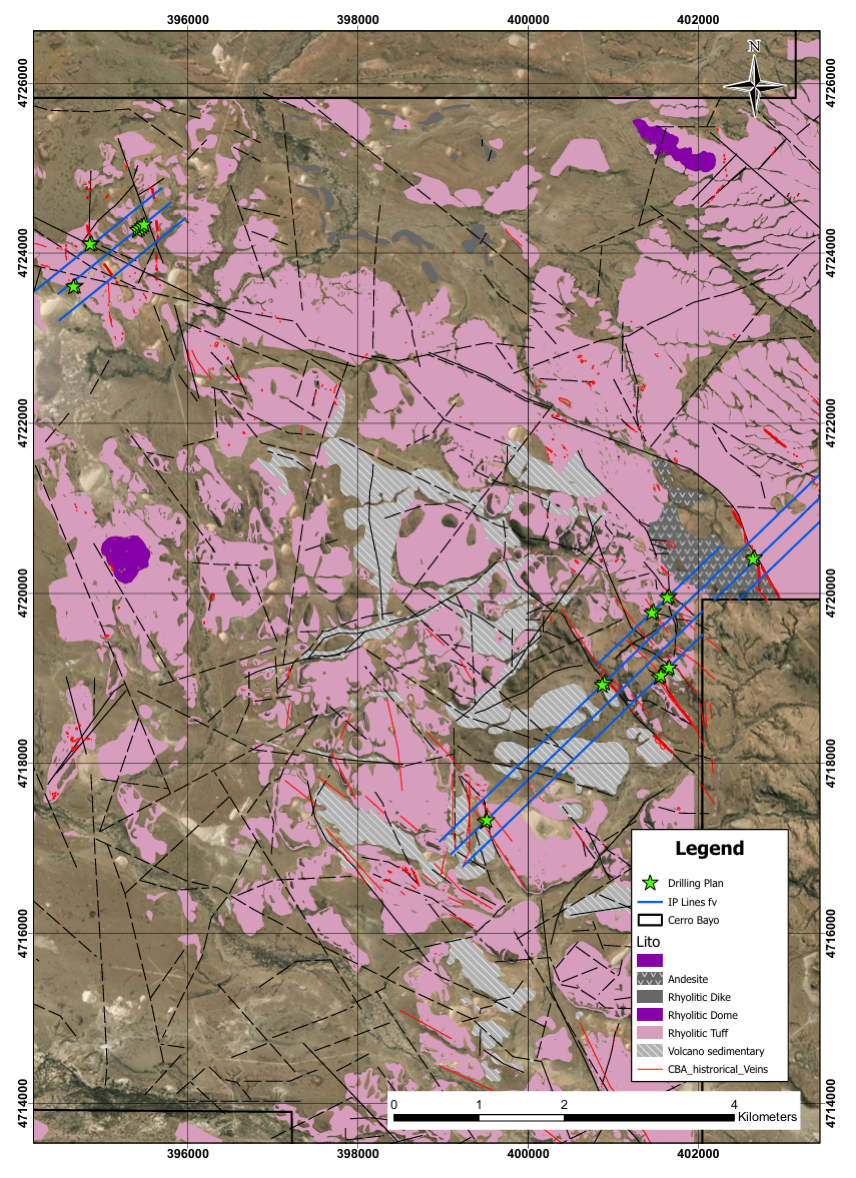

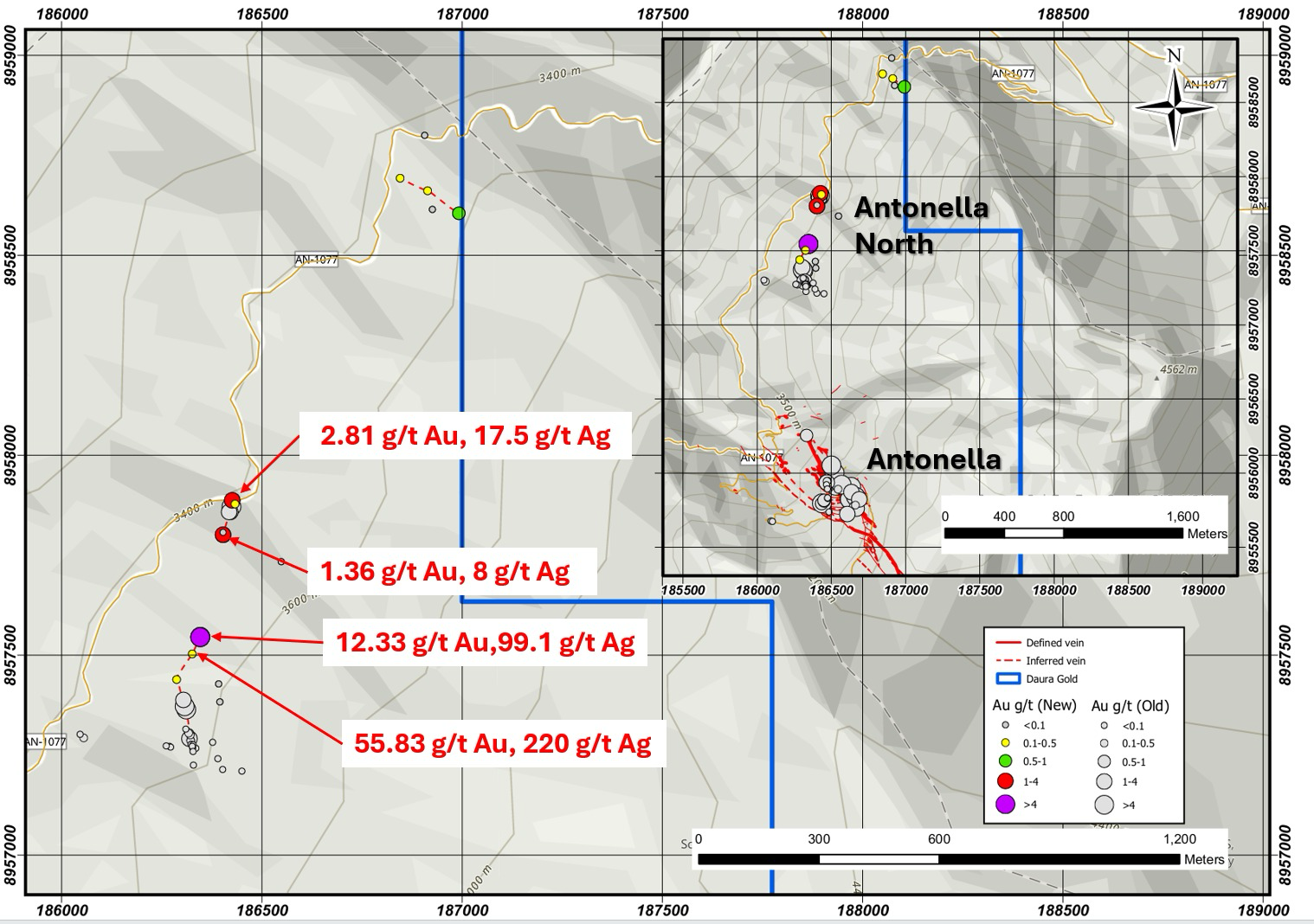

Net proceeds from the Concurrent Financing will be used to fund exploration of the Estrella project portfolio (further details of which are to be provided), expenses related to the Qualifying Transaction, and for general working capital purposes. Subject to TSXV approval, Daura may pay eligible finders a fee equal to 7% of the Concurrent Financing in cash and 7% in share purchase warrants ("Compensation Warrants") having the same terms and conditions as the Warrants.

All securities issued under the Concurrent Financing will be subject to hold periods expiring four months and one day after the date of issuance. Additional restrictions may apply under the rules of the TSXV and applicable securities laws.

This news release does not constitute an offer to sell, or solicitation of an offer to buy, nor will there be any sale of any securities offered in any jurisdiction where such offer, solicitation, or sale would be unlawful, including the United States. The securities offered as part of the Concurrent Financing have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and accordingly may not be offered or sold in the United States unless in compliance with the registration requirements of the U.S. Securities Act or pursuant to applicable exemptions.

Closing of the Concurrent Financing is subject to TSXV approval.

Additional Information

In accordance with TSXV policies, Daura Shares are currently halted from trading and will remain halted until further notice. Daura and Estrella will provide further details regarding the Qualifying Transaction in due course by way of press releases.

All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by Daura’s management. If and when a definitive agreement between Daura and Estrella is executed, Daura will issue a subsequent press release containing details of the definitive agreement and additional terms of the Qualifying Transaction. These details will include information on Estrella’s properties, sponsorship, summary financial information, the names and backgrounds of all persons expected to be principals and insiders of the resulting issuer, and additional information about the Concurrent Financing.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

For Further Information, Please Contact:

Daura Capital Corp.

543 Granville, Suite 501

Vancouver, BC V6C 1X8

William T.P. Tsang

CFO and Secretary

(604) 669-0660

btsang@seabordservices.com

Mark D. Sumner

CEO and Director

mark@kiwandagroup.com

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking statements that reflect management's current estimates, beliefs, intentions, and expectations. These statements are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control.

Such factors include, but are not limited to: risks and uncertainties related to Daura's ability to complete the proposed Qualifying Transaction; future prices and supply of gold and other metals; environmental liabilities (known and unknown); general business, economic, and competitive uncertainties; and results of exploration programs. In addition, mineralization on adjacent properties may not be indicative of the mineralization found on properties owned by the target of the proposed Qualifying Transaction.

Accordingly, actual results and future events may differ materially from those anticipated in forward-looking statements. Daura disclaims any obligation to publicly update or revise any forward-looking information, except as required by law.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. THE TSX VENTURE EXCHANGE HAS IN NO WAY PASSED UPON THE MERITS OF THE PROPOSED TRANSACTION AND HAS NEITHER APPROVED NOR DISAPPROVED THE CONTENTS OF THIS PRESS RELEASE.

share this

Other Recent Daura Gold News Releases.