November 3, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV:DGC) (the “Company” or “Daura”) is pleased to announce it has entered into a binding letter agreement (the “Agreement”) with Latin Metals Inc. (TSXV: LMS)(OTCQB: LMSQF) (“Latin Metals”), an arms-length party, granting Daura the right to earn up to an 80% interest in the Cerro Bayo and La Flora gold-silver projects (together, the “Projects”) located in the prolific Deseado Massif, Santa Cruz Province, Argentina.

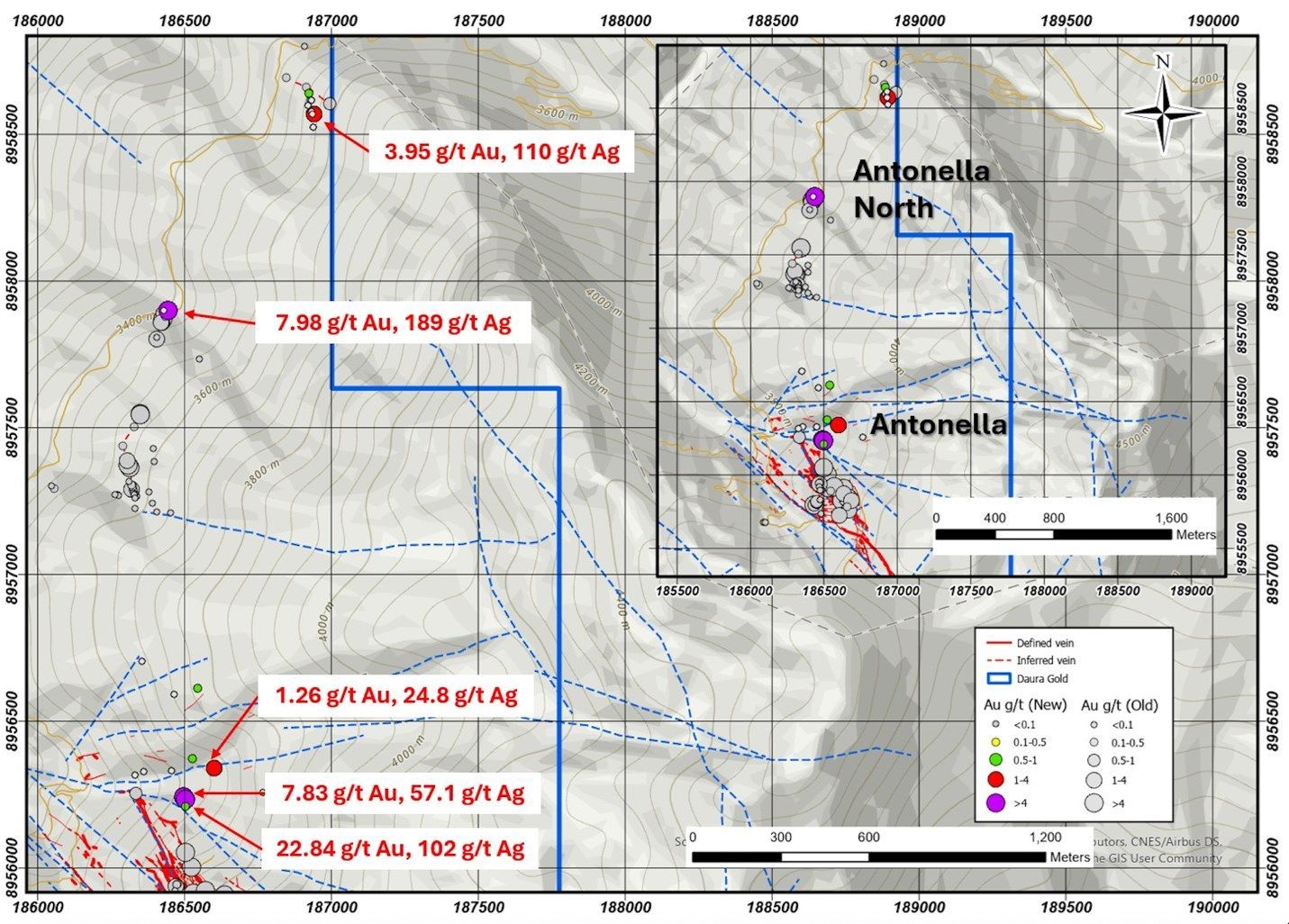

Mark Sumner, President of Daura Gold commented: “As Daura continues to advance its flagship Antonella Project in Peru, this agreement provides the Company with excellent optionality on a high-quality, drill ready target in the Deseado Massif, which is one of the world’s most prolific gold and silver districts. This agreement directly aligns with Daura’s strategy of targeting and advancing high-grade epithermal gold and silver systems in proven mineral belts, complementing the Company’s exciting projects in Peru.”

Cerro Bayo & La Flora: High-Grade Gold-Silver Potential in the Deseado Massif

The Cerro Bayo and La Flora Project lie in the heart of Argentina’s premier gold-silver district, the Deseado Massif, which has yielded more than 600 million ounces of silver and 20 million ounces of gold since 1990(1). The district hosts world-class operations such as Newmont’s Cerro Negro Mine (~7 Moz AuEq2) and Hochschild’s San Jose Mine (~64 Moz AgEq3).

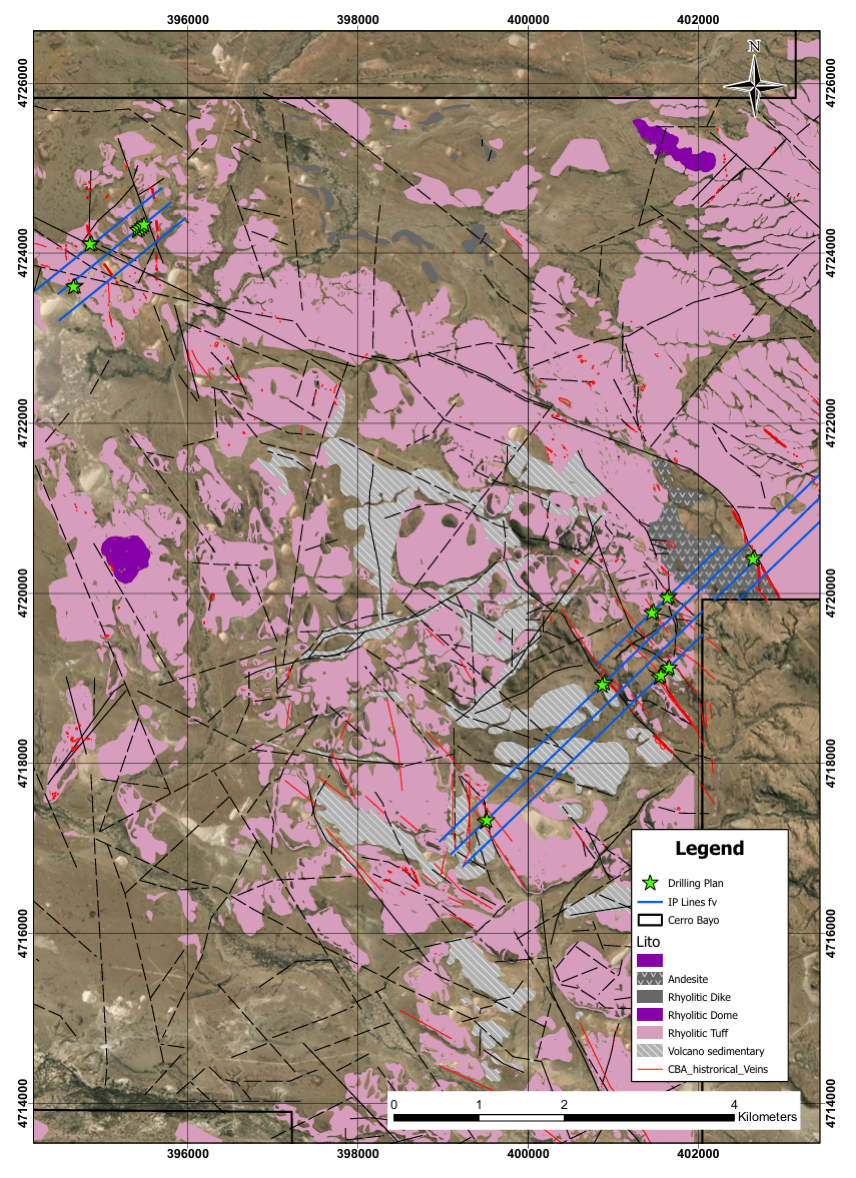

Exploration to date at Cerro Bayo has defined a 6-kilometre-wide structural corridor with multiple low-sulfidation epithermal-style vein target areas — the same style responsible for the region’s highest-grade precious metal deposits.

Key technical highlights include:

- Nine high-priority drill target areas identified by geochemistry, mapping, IP surveys and over 100 line-km of detailed magnetics;

- Surface Samples at La Flora have returned up to 71 g/t Au and 150 g/t Ag, and 82 g/t Au and 1,239 g/t Ag. And 2.3 g/t Au and 600 g/t Ag at Cerro Bayo.

- Drill ready with 21 fully permitted drill pads, following Environmental Impact Assessment (EIA) approval received in early 2025;

- Year-round access and strong infrastructure supporting a rapid exploration start-up;

- Geological and alteration characteristics consistent with known high-grade gold-silver systems in the Deseado Massif.

Option Terms

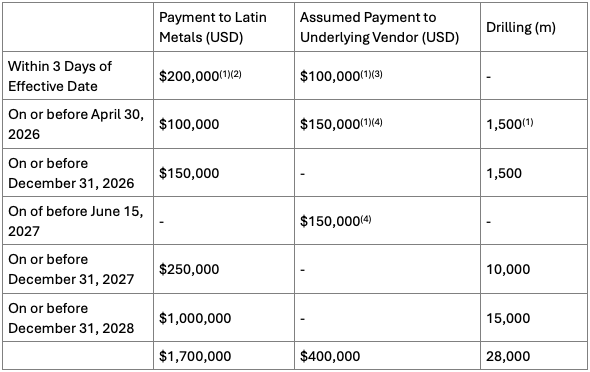

Daura will be granted the option (the “Option”) to earn a 75% undivided interest in the Projects for a period (the “Option Period”) of 38 months from the date of execution and delivery (the “Effective Date”) of the Letter Agreement.

To exercise the Option, Daura must make aggregate payments of US $1,700,000 to Latin Metals, assume payments of US $400,000 to the Underlying Vendor (as defined below), complete exploration work commitments, and prepare and deliver to Latin Metals a report prepared in accordance with Form 43-101F1 on the Properties (the “Technical Report”), addressed to Latin Metals and containing a mineral resource estimate on the Projects.

Irrevocable work commitments to be completed on or before April 30, 2026, are 50-line km of IP profiling, 150-line km of gradient array IP, and 1,500 meters of drilling. A total of 28,000m of drilling must be completed prior to the exercise of the Option.

The Projects are currently subject to an underlying purchase agreement (see news release dated June 25, 2025) between Latin Metals and Tres Cerros Exploraciones S.R.L. (the “Underlying Vendor”). The Underlying Vendor retains a 0.75% NSR royalty, 0.5% of which can be purchased for US $1,000,000, which cost will be assumed by Daura.

Top Up Right

Concurrently with the exercise of the Option, Daura may give notice to Latin Metals of its intention to increase its interest in the Projects to 80% (the “Top-Up Right”). To exercise the Top-Up Right, Daura must make cash payments to Latin Metals based on the measured, indicated and inferred mineral resources included in the mineral resource estimate set out in the Technical Report, as follows:

- US$7.00 per gold equivalent ounce of measured and indicated resources; and

- US$5.00 per gold equivalent ounce of inferred resources,

Table 1: Option Terms

Notes:

(1) $450,000 payments to Latin Metals and the Underlying Vendor, and 1,500m of drilling are irrevocable commitments.

(2) $200,000 payable to Latin Metals in cash or shares, at Daura's election, through the issuance of an equivalent monetary amount in Daura Shares.

(3) $100,000 to be retained by Latin Metals as reimbursement for amounts paid to the Underlying Vendor in 2025.

(4) Payments to be forwarded by Latin Metals to the Underlying Vendor.

The issuance of any Daura Shares to Latin Metals remains subject to the approval of the TSX Venture Exchange.

Joint Venture

Upon written notice by Daura to Latin Metals of the exercise of the Option (the “Option Exercise Notice”), Latin Metals and Daura will be deemed to have formed a joint venture (the “Joint Venture”) in respect of which the initial participating interests of the parties will be 75% Daura (80% if the Top-Up Right is exercised), and 25% Latin Metals (20% if the Top-Up Right is exercised).

Upon the formation of the Joint Venture, Daura will assume Latin Metals' existing right to repurchase 0.5% of the existing 0.75% net smelter returns royalty from the Underlying Vendor for US$1,000,000.

If the interest of either party falls below 10%, the parties’ interest will be converted to a 2% NSR royalty, of which half (being 1%) can be purchased by the other party for US $5,000,000 at any time until 3 months after a production decision.

Latin Metals Royalty Option

Following the Top-Up Right expiry date, and for 90 days thereafter, Latin Metals may elect in its sole discretion to convert its interest in the Joint Venture to a 3.0% net smelter returns royalty (the “Converted Royalty”), leaving Daura with a 100% interest in the Properties. Daura shall have the right to purchase 33.33% (being 1%) of the Converted Royalty upon the payment to Latin Metals of US$5,000,000 at any time until the date that is three (3) months after a production decision on the Projects has been made, in which case the Converted Royalty shall be reduced to 2.0%.

About Cerro Bayo and La Flora

In March 2025, Latin Metals received formal approval of the Environmental Impact Assessment (EIA), authorizing exploration drilling at Cerro Bayo. The approved permit includes authorization for 21 drill pads across the project area. A total of nine high-priority target areas defined by historical and recent exploration and the project is year-round accessible, with excellent infrastructure and an experienced workforce in Santa Cruz Province.

Exploration work completed to date, including geochemical sampling, detailed mapping, and over 100 line-km of magnetic surveys, has defined a 6 km-wide structural corridor with multiple low-sulfidation epithermal-style vein target areas.

Strategic Position in the Deseado Massif

Cerro Bayo and La Flora are located in the heart of the Deseado Massif, a prolific region with over 600 million ounces of silver and 20 million ounces of gold discovered since 1990.(1) The district hosts multiple producing mines and advanced-stage projects, including:

- Newmont’s Cerro Negro Mine (~7 Moz AuEq) (2)

- Hochschild’s San Jose Mine (~64 Moz AgEq) (3)

Cerro Bayo’s geological setting, structural controls, and alteration footprint are consistent with known high-grade gold-silver systems in the region.

About Latin Metals

Latin Metals Inc. is a copper, gold and silver exploration company operating in Peru and Argentina under a prospect generator model, minimizing risk and dilution while maximizing discovery potential. With 18 projects, the company secures option agreements with major mining companies to fund exploration. This approach provides early-stage exposure to high-value mineral assets. www.latin-metals.com

Qualified Person

Stuart Mills QP, is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Mills is not independent of the Company, as he is the Company’s Vice President of Exploration.

Readers are cautioned that the mineral deposits discussed above are adjacent properties and that Latin Metals has no interest in or right to acquire any interest in the deposits, and that mineral deposits on adjacent or similar properties, and any production therefore or economics with respect thereto, are not in any way indicative of mineral deposits on Latin Metals’ Cerro Bayo property or the potential production from, or cost or economics of, any future mining of any of Latin Metals’ mineral properties.

About Daura Gold Corp.

Listed on the TSX Venture Exchange, Daura is advancing high-impact exploration projects in Peru’s renowned Ancash region. Daura owns a 100% undivided interest in over 15,900 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target and adjacent 2,900 Libelulas concessions, which is the primary focus of Daura’s current exploration efforts.

For further information please contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

Cautionary Statement Regarding Forward Looking Information:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

- Sillitoe, R. H. & Hedenquist, J. W. (2003). Linking gold deposits to mineral systems

- Goldcorp Reserves & Resources Report

- Hochschild Mining Reports

share this

Other Recent Daura Gold News Releases.