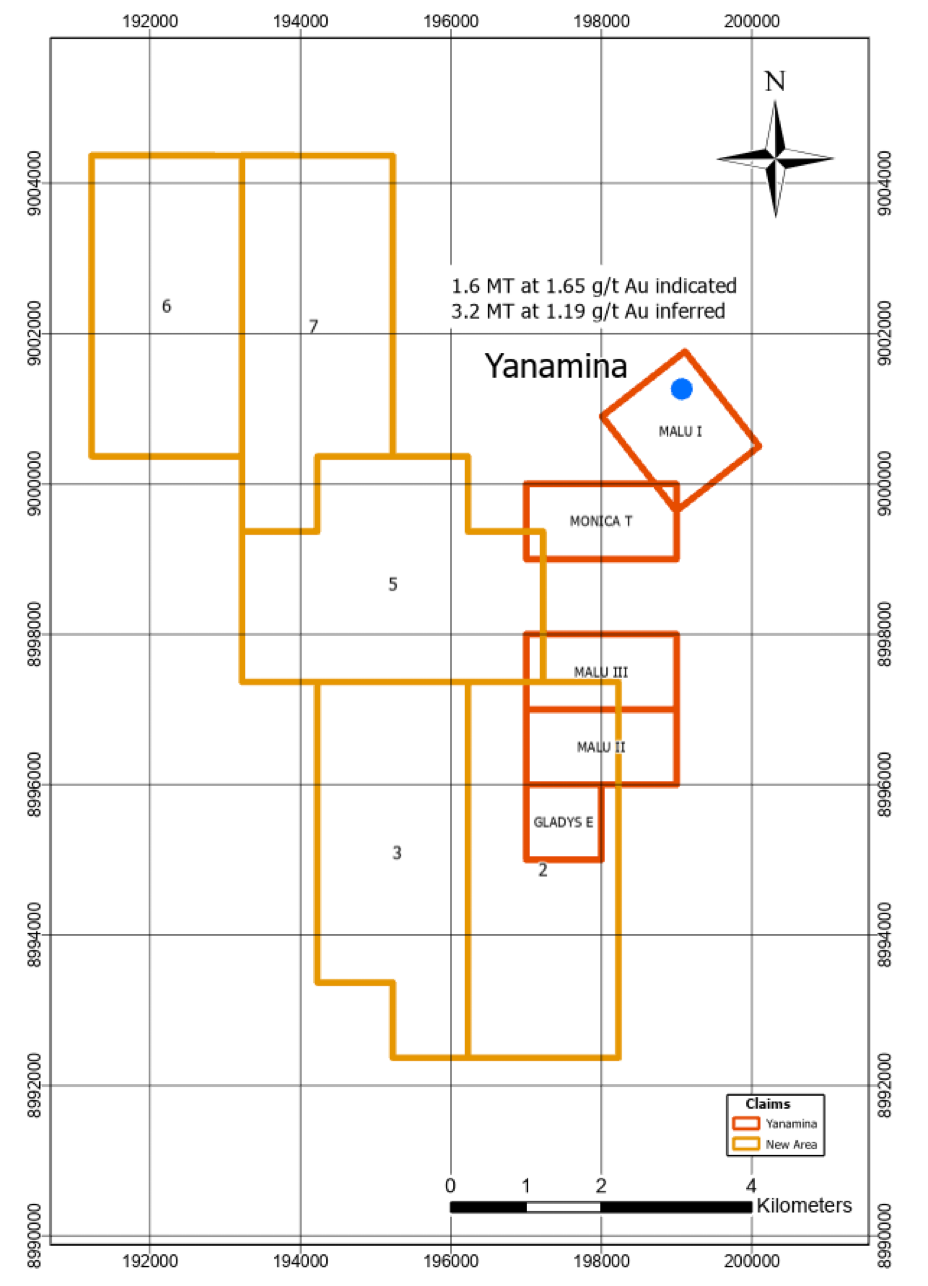

June 18, 2025 – Vancouver, British Columbia – Daura Gold Corp. (TSXV: DGC) (the “Company” or “Daura”) is pleased to announce the acquisition of an additional 4,700 hectares contiguous with the Yanamina gold-silver project (“Yanamina” or the “Project”) which is located within close proximity to the Yanamina historical resource. Daura plans to test outcrops in the these newly staked claims which present similar geology to the surficial mineralization at Yanamina.

Highlights:

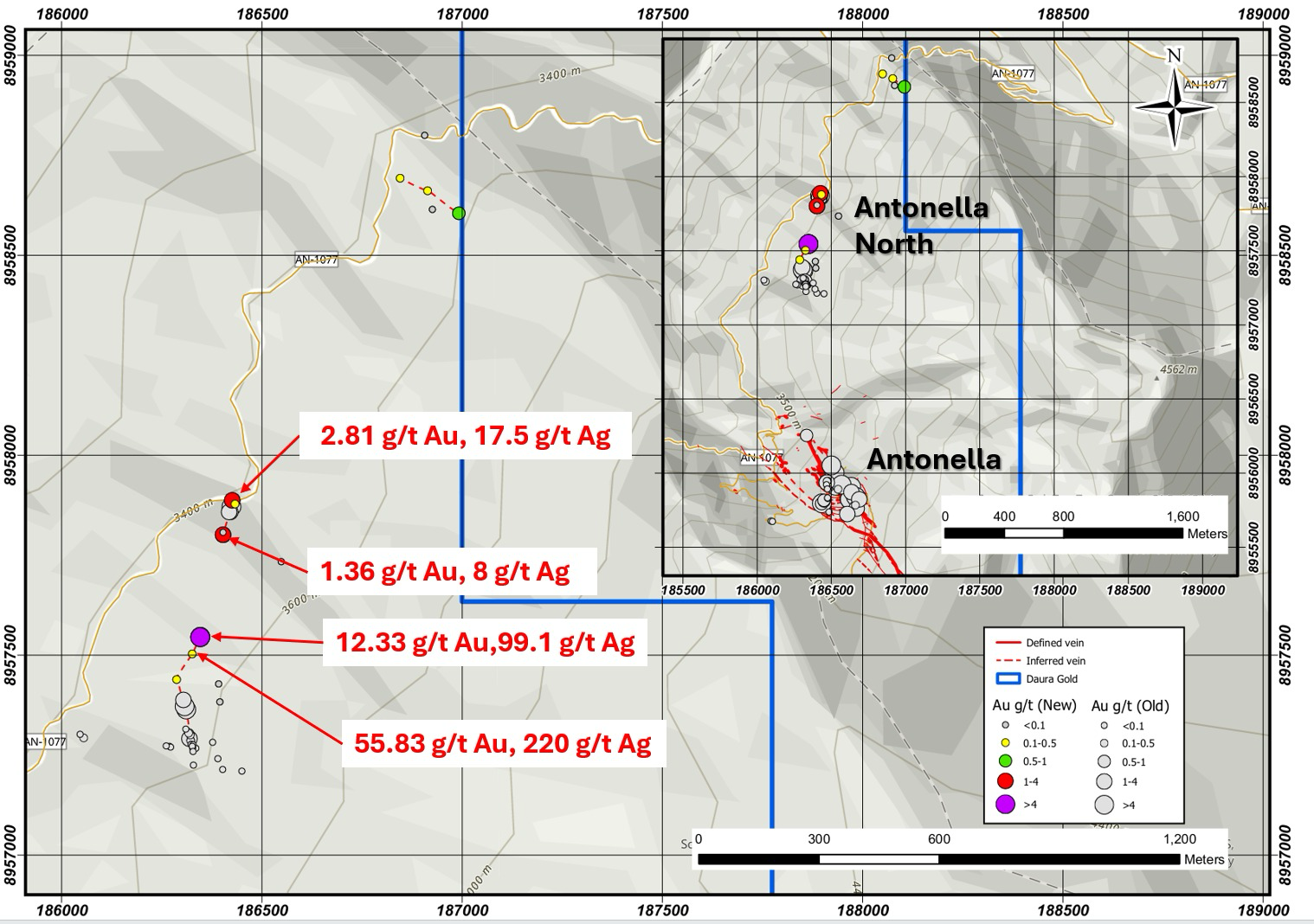

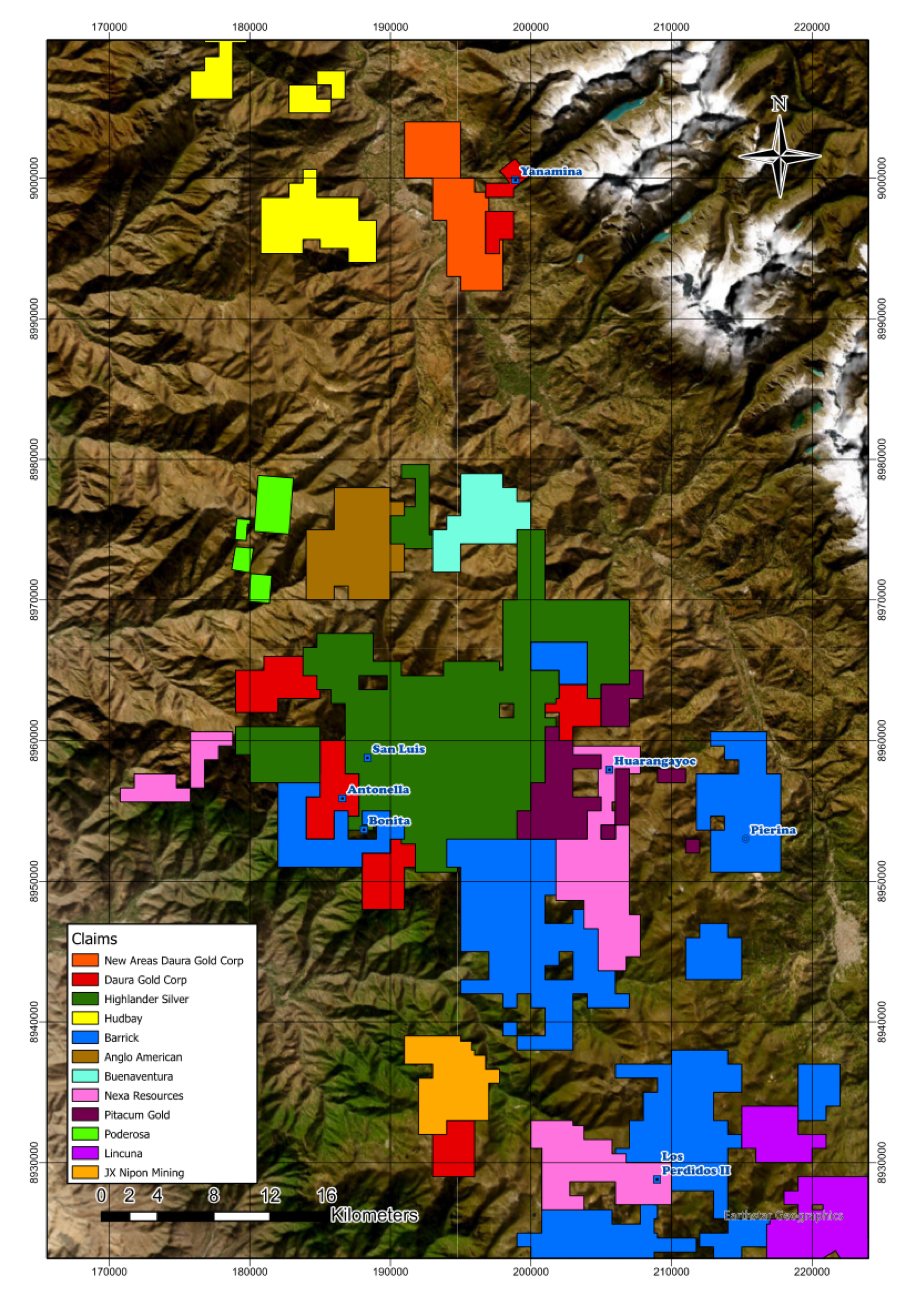

- Acquisition of newly staked 4,700 hectares in the Yanamina Project area, approximately 40km north of Daura’s high-grade Antonella target and the bonanza grade San Luis Gold Project owned by Highlander Silver.

- The Yanamina Project has historical indicated resources of 1,566,900 tonnes at 1.65 g/t Au for a total of 83,100 (oz) of gold (Au) and 3,235,000 tonnes at 1.19 g/t Au for a total of 123,700 ounces of Au. The Company plans to undertake work to verify and update the historical estimate as a priority.

- The newly staked claims are 5 km from HudBay’s Ancash exploration project.

- Yanamina compliments Daura’s project portfolio in the Ancash Department, which is well-known for mining in Peru with major historical production from Barrick’s Pierina gold mine, approximately 40km from Yanamina. And 94km from the Tier 1 Antamina Mine, owned by Glencore, Teck and Mitsubishi.

A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource.

Luis Saenz, Daura CEO commented: “The expansion of our land position at Yanamina represents a significant step forward in our strategy to build a high-quality gold-silver portfolio in one of Peru’s most prolific mining regions. The newly acquired claims lie in a highly prospective area that mirrors the geology of known surficial mineralization at Yanamina and strengthens our exploration pipeline. With historical resources already defined, our next steps will focus on validating and expanding the resource base while unlocking new targets across this underexplored ground.”

Engagement of Third Party Investor Relations Service Providers

The Company has engaged Elaine Einarson as a third-party investor relations service provider.

Ms. Einarson, based in Vancouver, British Columbia, has approximately 20 years of experience acting as an investor relations consultant. Ms. Einarson has been engaged on a month-to-month basis and will be paid a monthly fee of C$2,500. Ms. Einarson is an arm’s length party to the Company and does not currently own any securities of the Company.

Qualified Person

All scientific and technical information contained in this news release has been reviewed, verified and approved by Owen D. W. Miller, Ph.D. Member AIG, a qualified person as defined in National Instrument 43-101. Dr. Miller acts as an independent third-party consultant of the Company.

About Daura Gold Corp.

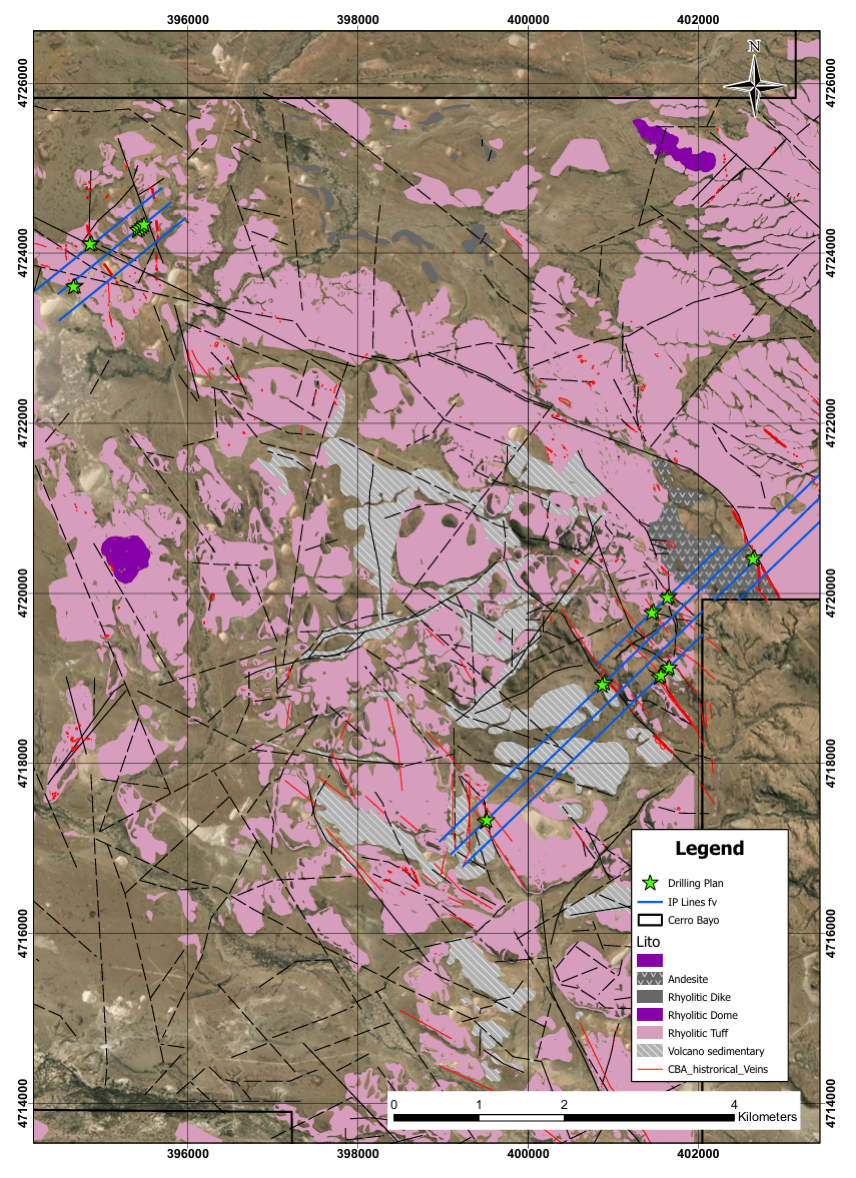

Listed on the TSX Venture Exchange, Daura Gold Corp is advancing high-impact exploration projects in Peru’s renowned Ancash region. Daura Gold owns a 100% undivided interest in over 8,100 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target, which is the primary focus of Daura Gold’s current exploration efforts.

For further information please contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

Cautionary Statement Regarding Forward Looking Information:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

share this

Other Recent Daura Gold News Releases.