Vancouver, British Columbia — (February 19th, 2025) – Daura Gold Corp. (formerly Daura Capital Corp.) (TSXV:DGC) (the “Company” or “Daura”) is pleased to provide an operational update on the progress of its planned exploration efforts for its mineral properties located in the Ancash region of Peru. In addition, the Company announces that it has entered into a debt settlement agreement to settle outstanding indebtedness owed to an arms-length third party, and has engaged the services of third party investor relations providers.

Operational Update

During the challenging period of the Covid-19 shutdown, thanks to the unwavering support of our founding investors, the Company successfully maintained its key properties and kept open lines of communication with stakeholders within the communities. In this timeframe, Daura worked with Estrella to finalize payments on the flagship Antonella property, reinforcing the Company’s commitment to consolidating its presence within the district. Completing this acquisition came at a pivotal moment, as the district has since garnered increased attention from both junior and major mining companies.

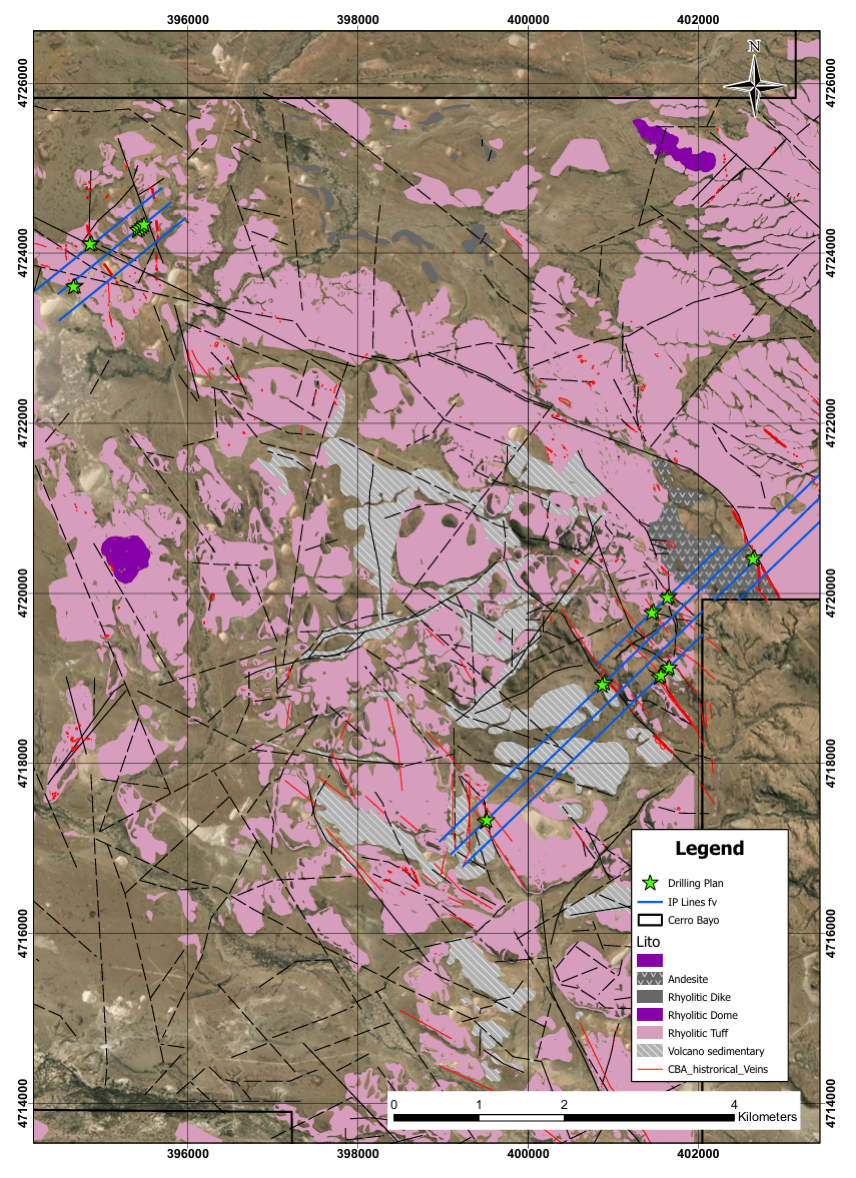

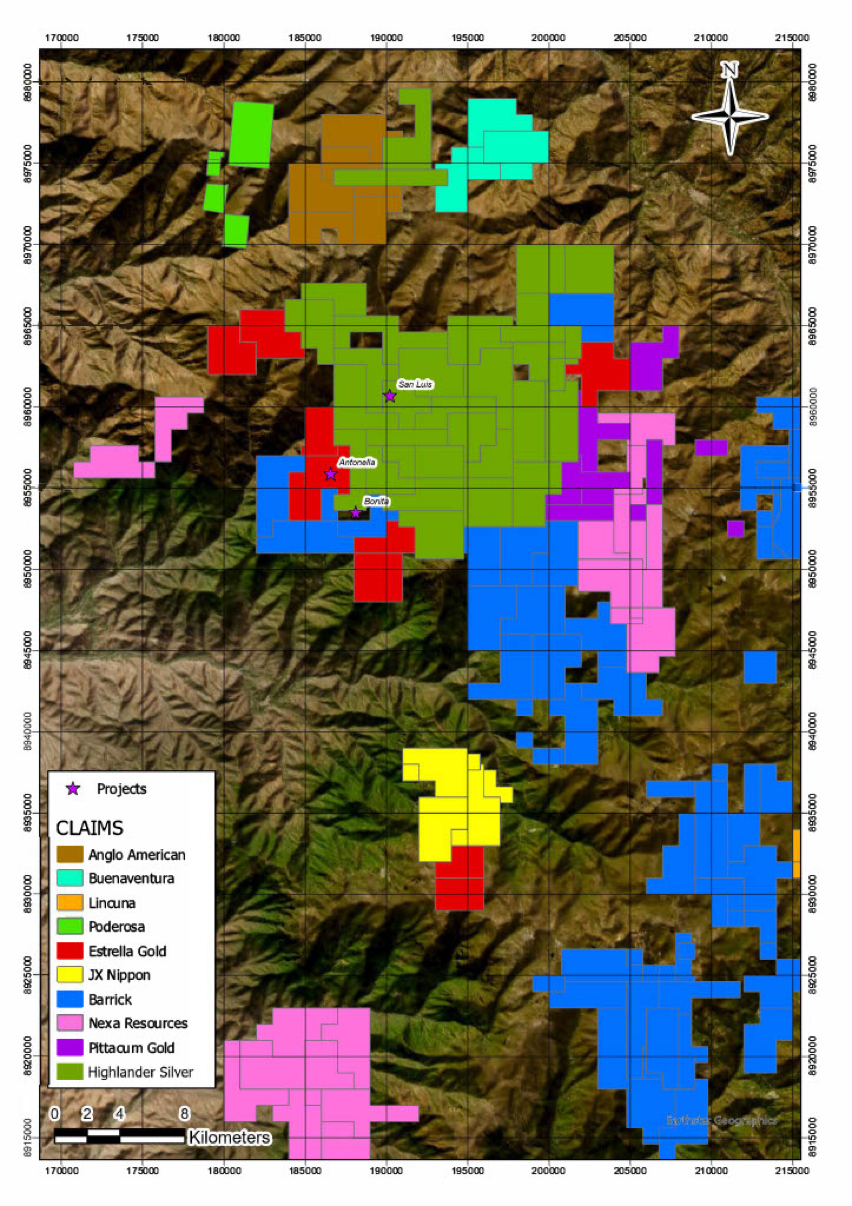

Over the past few months, the team has been diligently engaged in updating the geological models and preparing for essential fieldwork in the coming months. Daura has prioritized establishing strong relationships with various stakeholders in the community, fostering dialogue with local companies within the district. Engaging with communities affected by the Company’s projects is a crucial next step that will pave the way for exploration activities on Daura’s properties. Daura has also engaged with the various other mining companies in the district who also plan on doing extensive work in the region. Please see figure 1 for land package and other major mining companies who are operating in the region.

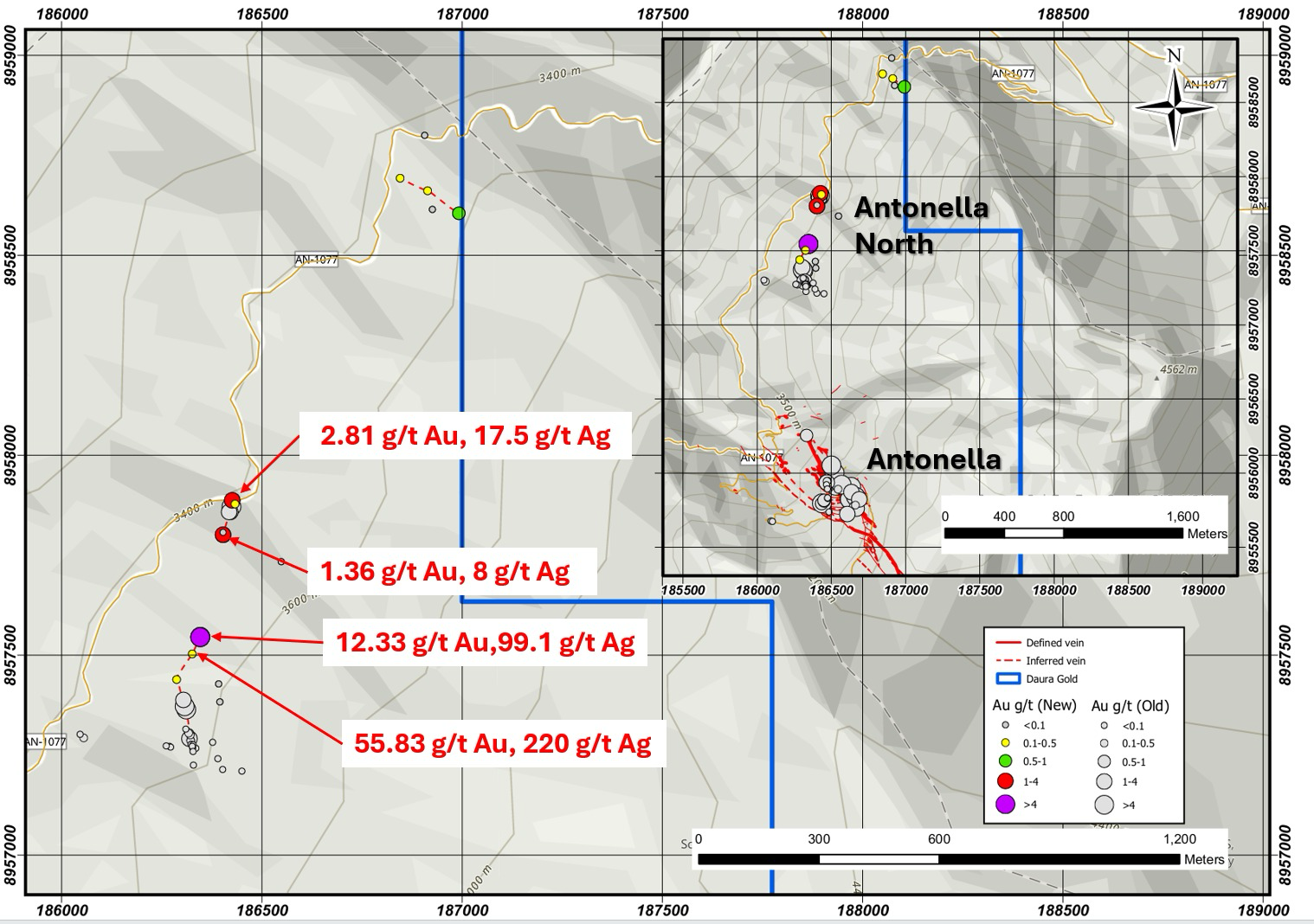

The Company’s technical team is set to initiate a comprehensive mapping and sampling campaign across its extensive 8,100-hectare land package. The program will commence with targeted areas around the Antonella site to follow up on the previous 2,461 meter drill campaign which delivered high grade intercepts, including:

- CBD11007: 0.85m @ 8.73 g/t Au

- CBD11004B: 1.2m @ 8.69 g/t Au

- CBD11001: 0.20m @ 47.2 g/t Au

The primary goal of the initial fieldwork is to confirm drilling targets for the forthcoming exploration campaign. This initiative will also facilitate the preparation and submission of the Company’s drilling permit application.

Daura remains committed to consolidating its position in the district and exploring growth opportunities in the region. The Company is dedicated to leveraging its local presence and established relationships while being mindful of the limited capital available. As such, the Company will prioritize, optimize, and deliver results that serve the best interests of its shareholders.

Luis Saenz, CEO of Daura, stated: “It is an exciting time to be in the district that hosts the well-known San Luis project, now in the hands of Highlander Silver. The entire region is of interest not only for the historical gold and silver production and prospectivity, but also indications of copper discoveries that have interested some of the majors to the area. Our small but dedicated team has worked for several years to put this package in place and maintain it, and we look forward to beginning work in earnest to create value for our shareholders. We look forward to providing news on our progress in various fronts in the coming weeks."

Figure 1. below represents Daura’s land package and the surrounding major mining companies who are also active in the region.

Shares for Debt Settlement

Daura also announced today that it has entered into a debt settlement agreement to settle $101,200 in outstanding debt owed to an arms-length party through the issuance of an aggregate of 1,686,666 units of the Company (the “Units”) at a price of $0.06 per Unit (the “Debt Settlement”).

Each Unit to be issued consists of one common share of the Company and one common share purchase warrant (each a “Warrant”), with each Warrant being exercisable for one additional common share at a price of $0.10 per share for a period of two years from the date of issuance.

Closing of the Debt Settlement is subject to customary closing conditions, including the approval of the TSX Venture Exchange ("TSXV"). The securities to be issued pursuant to the Debt Settlement will be subject to a hold period of four months and one day following the date of issuance, in accordance with applicable securities laws and TSXV policies.

Engagement of Third-Party Investor Relations Service Providers

Daura has engaged the services of ImpactDeck, a leading investor relations firm specialising in resource companies. ImpactDeck will assist Daura in increasing its visibility within the investment community and enhancing engagement with key investors.

In consideration of the services to be provided, Daura will pay ImpactDeck cash consideration of $20,000 for an initial six-month term, starting February 1, 2025 and ending on July 31, 2025, with the option to continue on a month-to-month basis at a fee of $4,000 per month thereafter. ImpactDeck is a leading investor relations consultant lead by James McFarland and based in Montreal, Quebec. ImpactDeck does not directly or indirectly have an interest in the securities of the Company.

Daura has also engaged the services of Morgan Knowles as an independent contractor for investor relations for a six-month period at fee of $5,000 per month, starting February 1, 2025, the first four months of which will be paid upfront. In addition, subject to the policies of the TSXV, the Company has agreed to grant Ms. Knowles 150,000 options under the Company’s stock option plan at the same exercise price and on the same terms as will be set by the Company for the next grant of options to be made by the Company. Ms. Knowles is an arms-length service provider to the Company based in Toronto, Ontario. With the exception of the aforementioned options, Ms. Knowles does not directly or indirectly have an interest in the securities of the Company.

Qualified Person

All scientific and technical information contained in this news release has been reviewed, verified and approved by Owen D. W. Miller, Ph.D. FAusIMM(CP), a qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Miller acts as an independent third party consultant of the Company.

About Daura Gold Corp.

Listed on the TSX Venture Exchange, Daura Gold Corp is advancing high-impact exploration projects in Peru’s renowned Ancash region. Daura Gold owns a 100% undivided interest in over 8,100 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target, which is the primary focus of Daura Gold’s current exploration efforts.

For further information please contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

btsang@seabordservices.com

Cautionary Statement Regarding Forward Looking Information:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

share this

Other Recent Daura Gold News Releases.