Vancouver, British Columbia--(Newsfile Corp. - July 23, 2024) - Daura Capital Corp. (TSXV: DUR.P) (the "Company" or "Daura"), a capital pool company under the policies of the TSX Venture Exchange (the "TSXV"), is pleased to provide an update on the status of its proposed qualifying transaction (the "Qualifying Transaction") to acquire Estrella Gold S.A.C. ("Estrella").

As previously announced, Daura has entered into a definitive agreement to acquire all of the outstanding shares of Estrella from its shareholders (the "Estrella Shareholders") in consideration for 7,000,000 common shares of Daura. In addition, Daura has made its initial filings with the TSXV to seek conditional acceptance of the proposed Qualifying Transaction. Daura is continuing to work diligently towards the completion of the proposed Qualifying Transaction under the policies of the TSXV.

About Estrella Gold S.A.C. and the Cochabamba Project

Estrella is a closely held corporation (S.A.C.) formed under the laws of Peru, engaged in the acquisition and exploration of mineral resource properties. Estrella was formed in August 2018 for the purpose of engaging in the business of acquiring, exploring and developing mineral resource properties. Estrella's principal focus to date has been on the acquisition of the mining concessions and applications making up the Cochabamba Project.

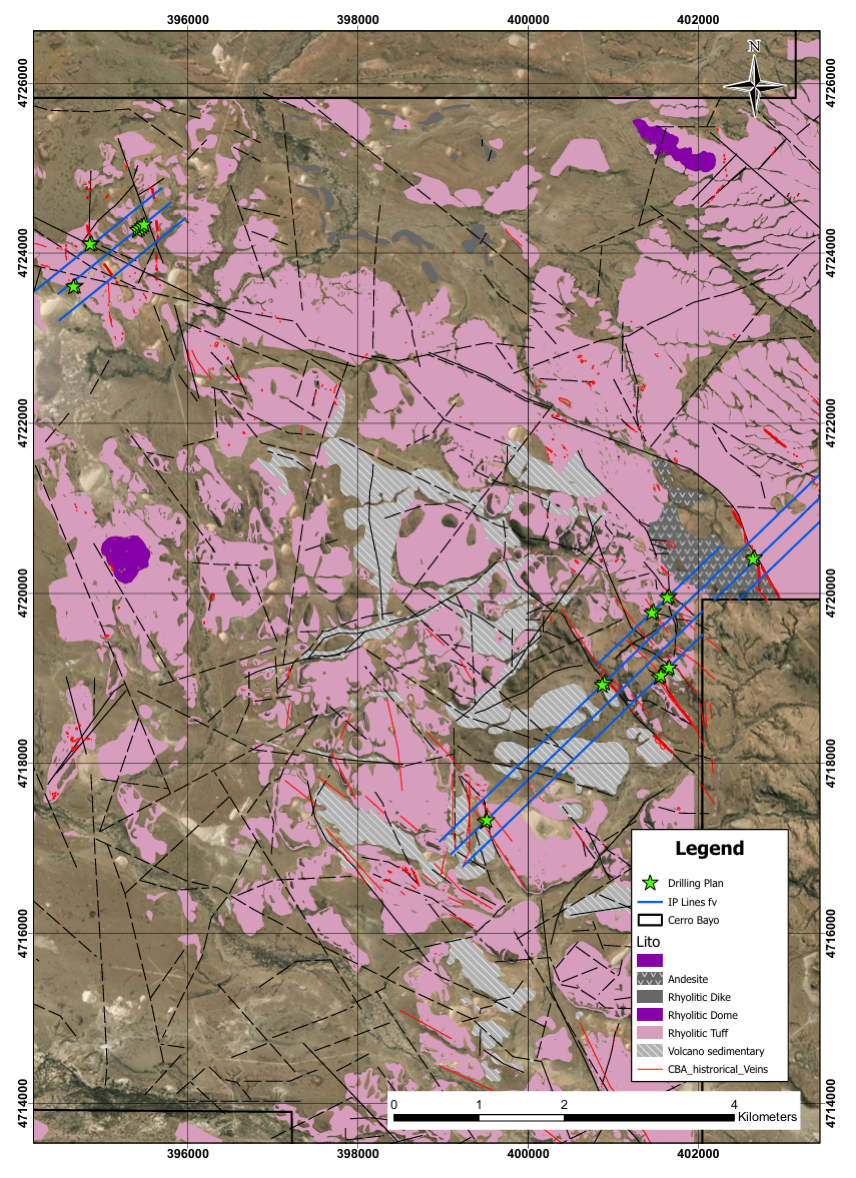

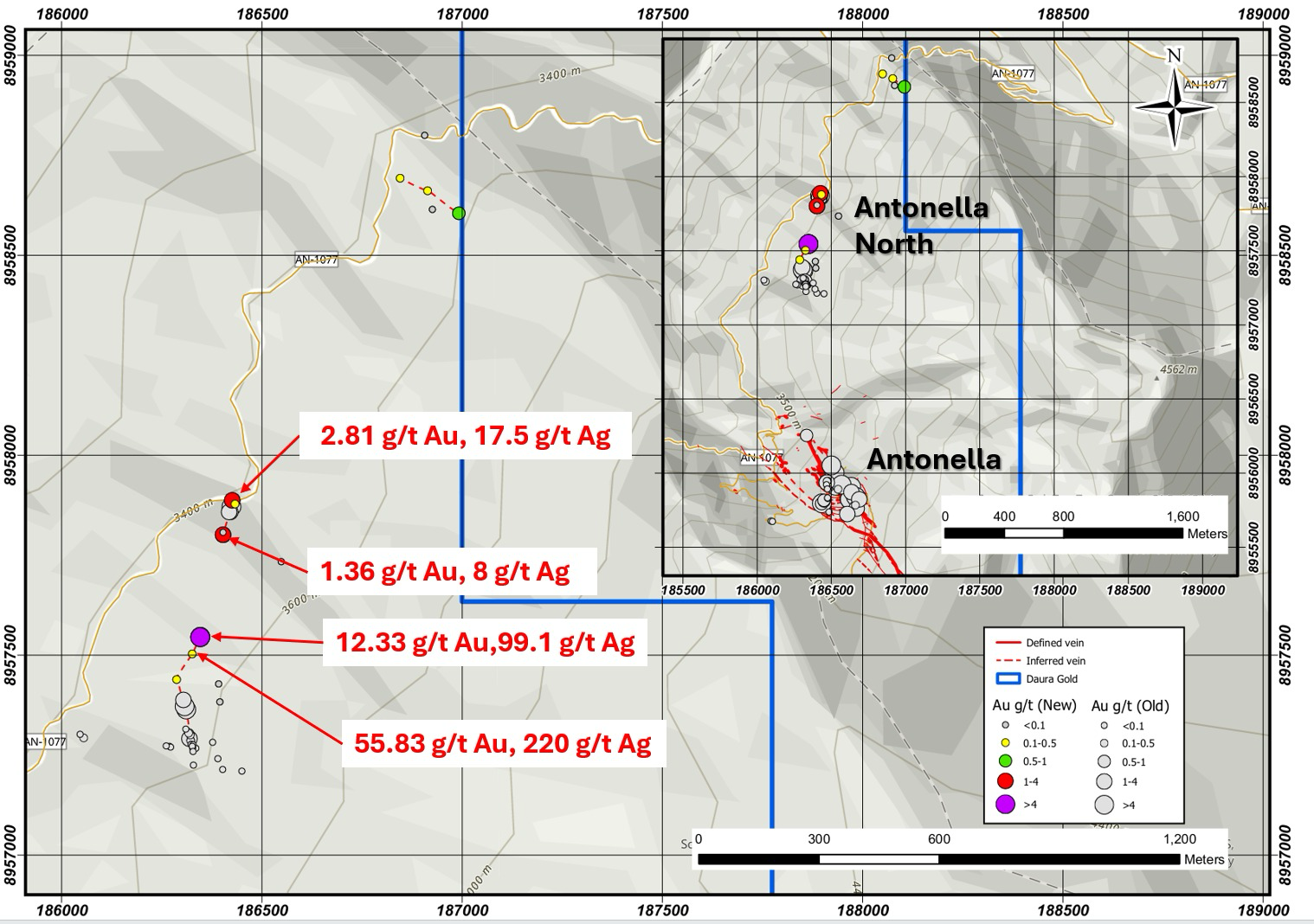

The Cochabamba Project consists of 10 mining concessions covering an effective area of 7,223.87 Ha, located on the western flank of the Cordillera Negra, in north central Peru. Included in the Cochabamba Project mining concessions that Estrella owns is the Antonella Daniela I Concession. The Antonella Daniela I Concession covers an area of 900Ha and is currently the main area of interest on the Cochabamba Project. The mineralized veins of the old Esperanza mine form the current main area of interest and were the focus of the bulk of previous exploration activity. The mine is centered at 187,000mE 8,956,000mN and at an altitude of 3700 meters above sea level, and lies entirely within the Antonella Daniela I Concession. Politically the project is located within the Rural Community/Districts Cochabamba, Cacchan, Ecash and Colcabamba, in the Province of Huaraz, Department of Ancash. The Cochabamba Project is an exploration stage project prospective for gold, silver, copper, lead and zinc.

To read the rest of this news release please visit: https://www.newsfilecorp.com/release/217533/Daura-Capital-Corp.-Provides-Update-on-Proposed-Qualifying-Transaction

share this

Other Recent Daura Gold News Releases.