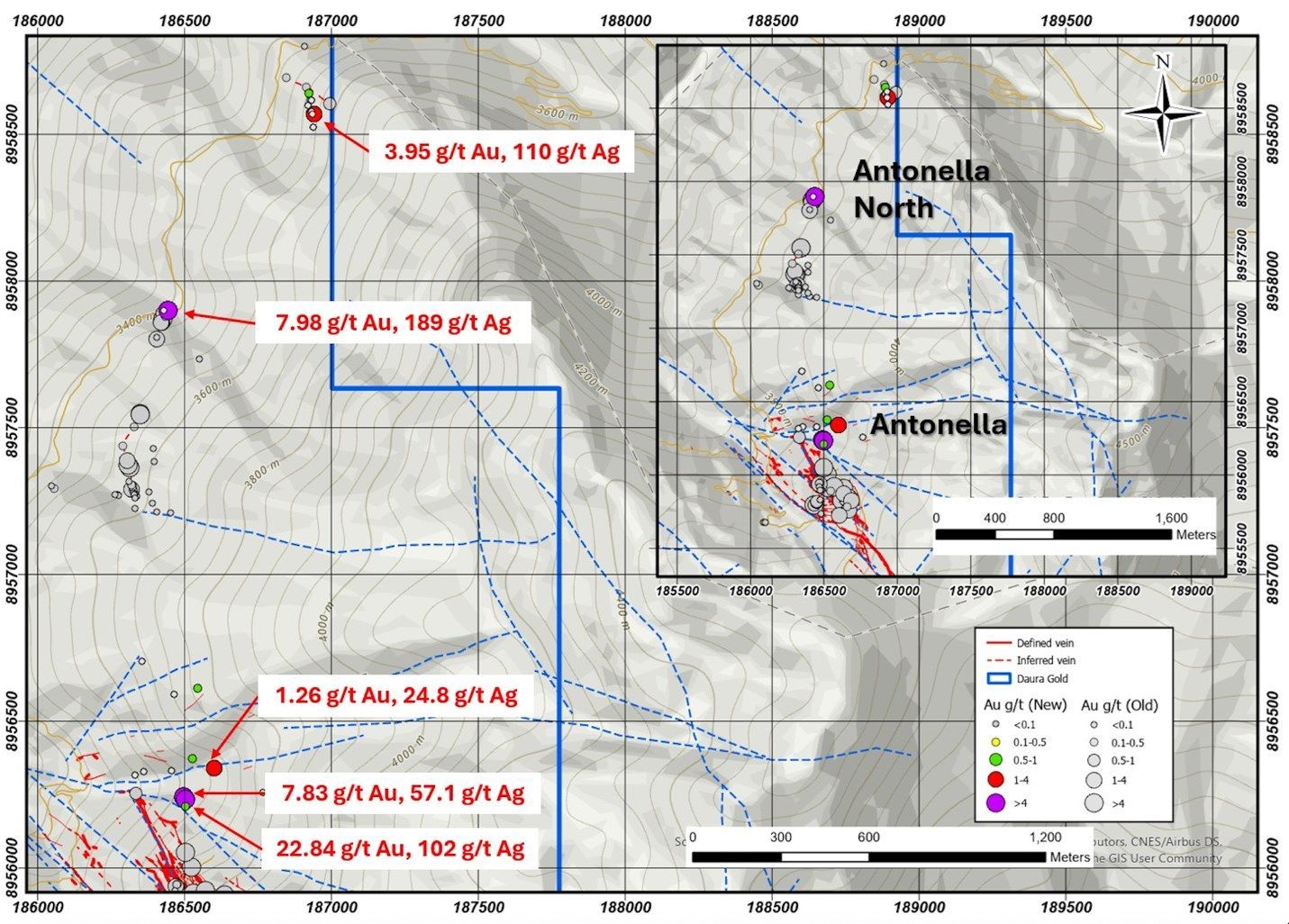

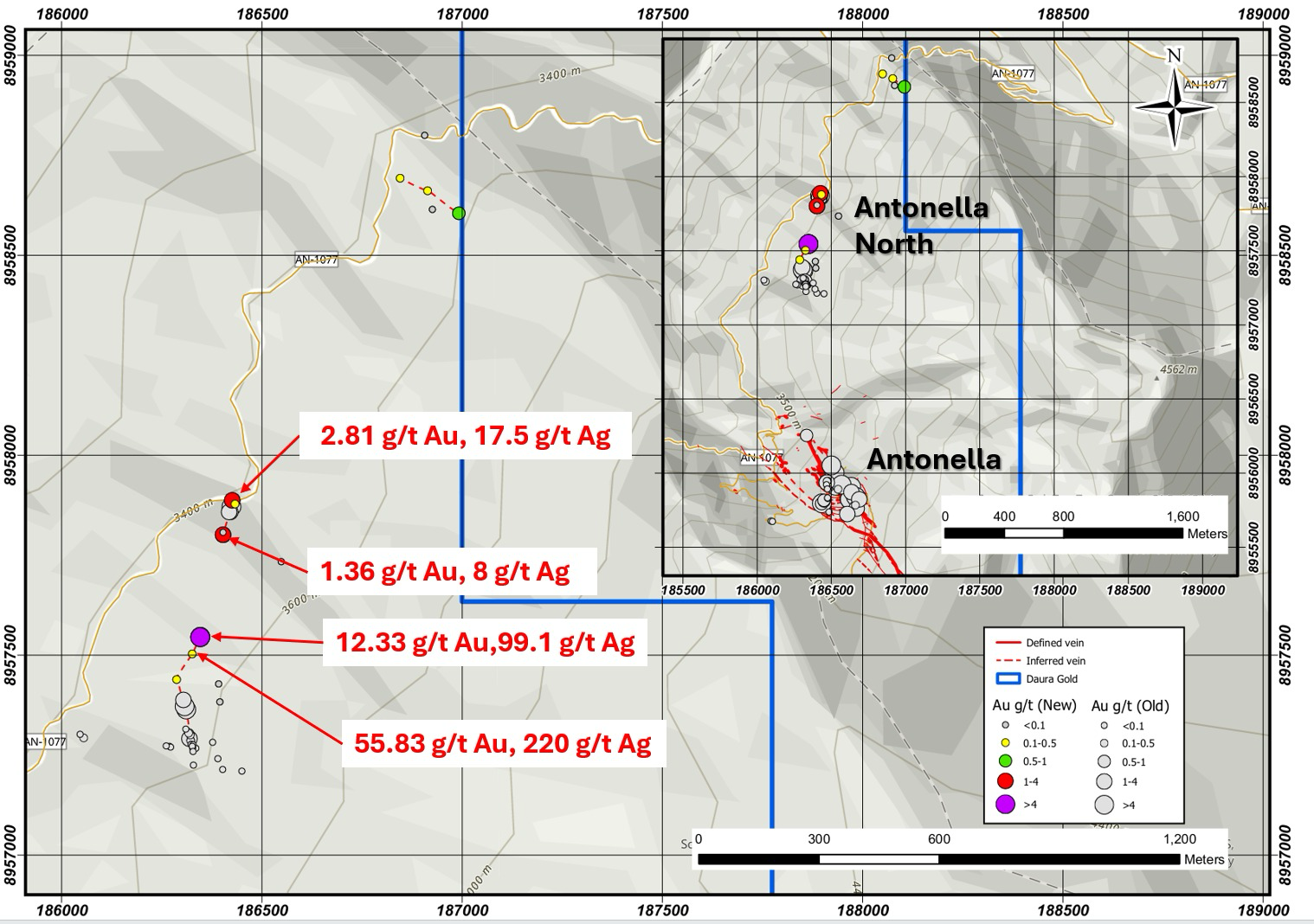

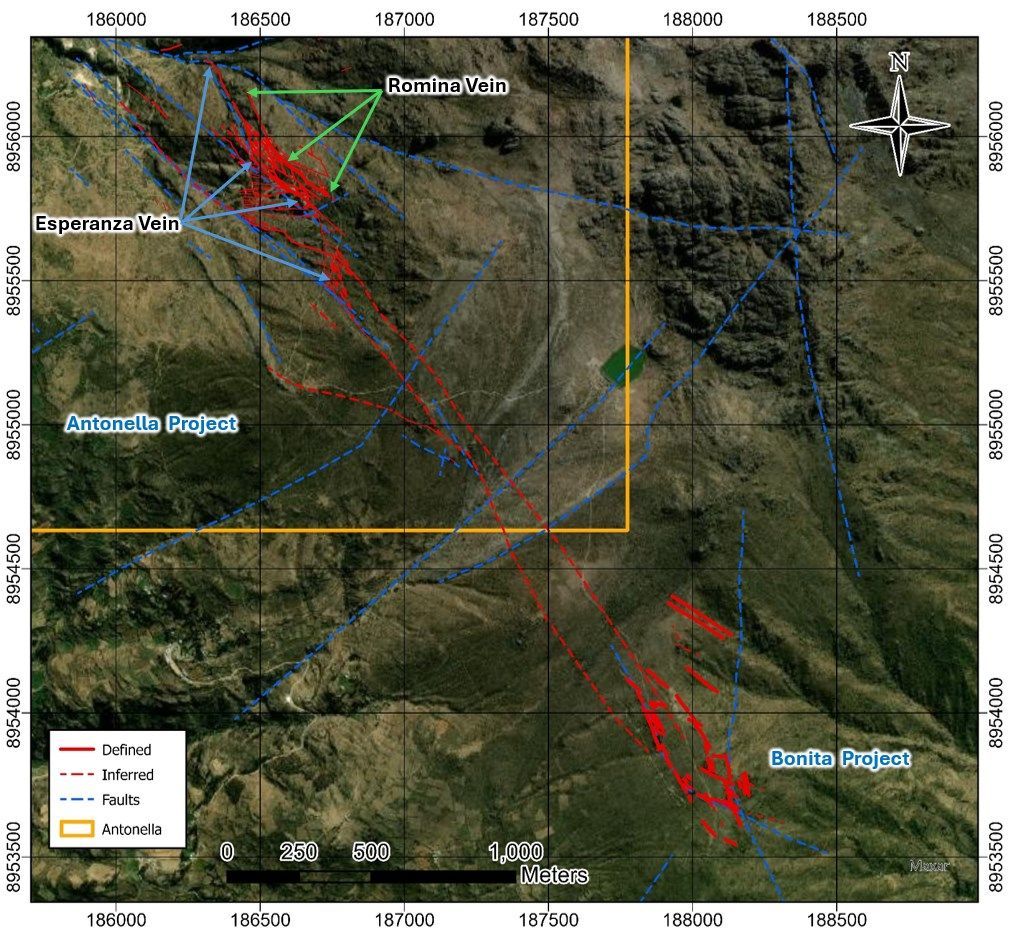

September 9, 2025 – Vancouver, British Columbia – Daura Gold Corp. (formerly Daura Capital Corp.) (TSXV:DGC) (the “Company” or “Daura”), is pleased to announce high-grade surface sampling results and the delineation of vein extensions at the Antonella Project ("Antonella" or the "Project") in Ancash, Peru. The work confirms strong gold and silver mineralization and supports the continuity of Antonella's vein system toward Highlander Silver Corp's adjacent Bonita Project, reinforcing the potential for a unified mineralized corridor.

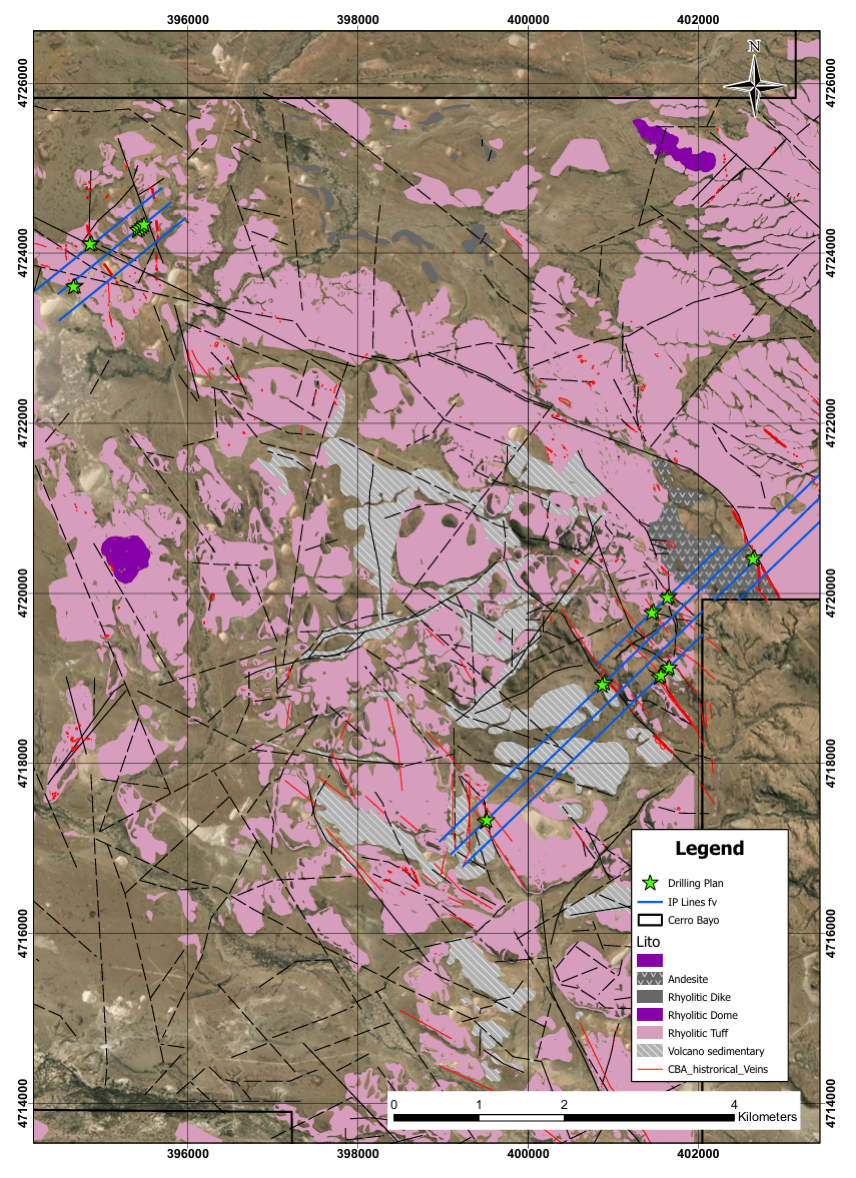

Antonella is located in a prolific metallogenic belt hosting significant deposits such as Antamina and Barrick's past producing Pierina gold mine. The Project's vein system is hosted in Tertiary volcanic rocks of the Calipuy Group and controlled by NW-SE trending faults, with silicification and argillic alteration halos up to 40 meters wide.

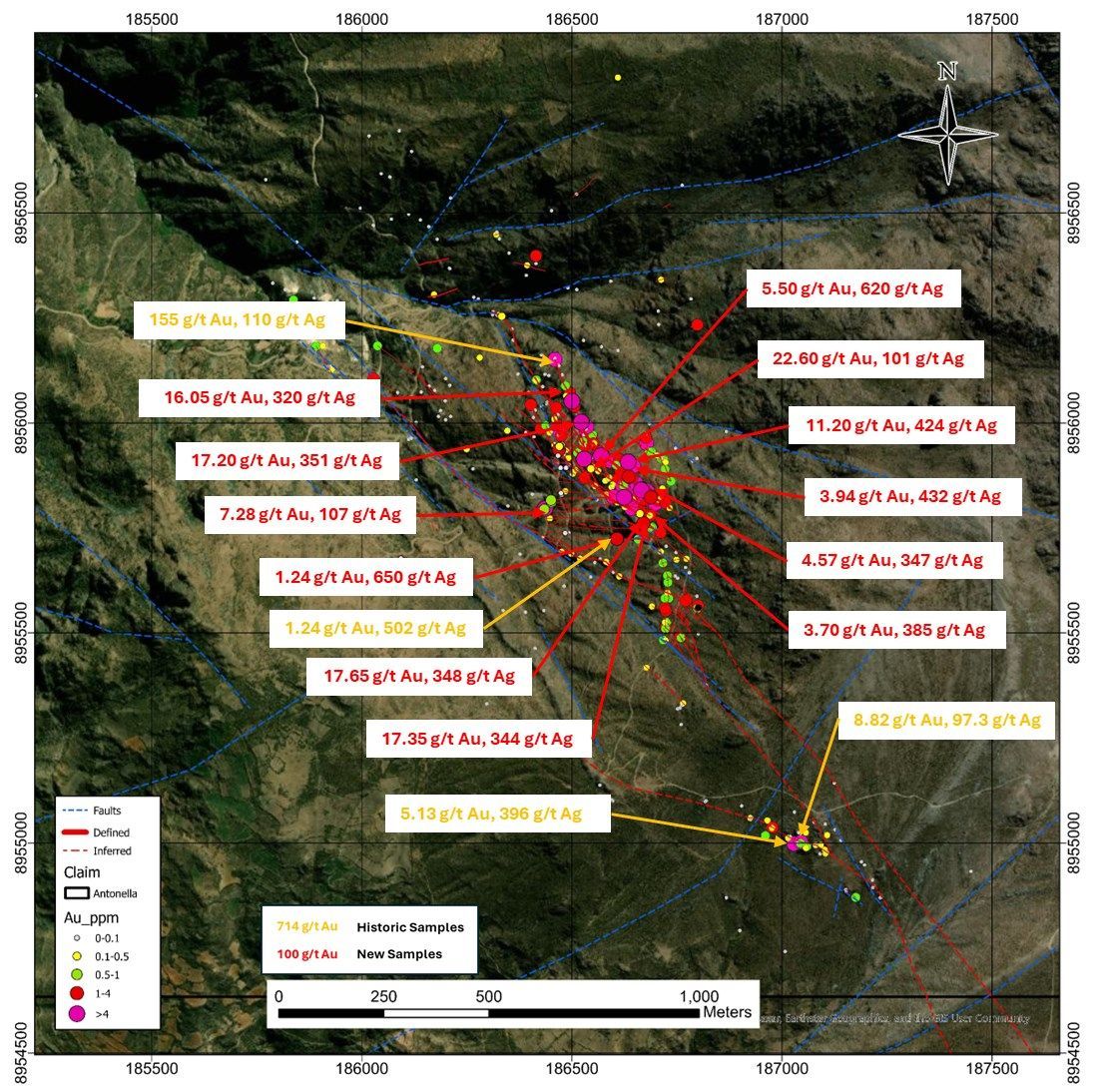

Highlights of the Sampling Program:

- 47 rock chip samples collected across the Antonella vein system and southwest extensions.

- 19 samples exceeding 100 g/t Ag, with values up to 650 g/t Ag.

- 6 samples exceeding 10 g/t Au, with grades up to 22.6g/t Au.

- Standout samples include:

- 22.6 g/t Au & 101 g/t Ag;

- 17.65 g/t Au & 348 g/t Ag; and

- 16.05 g/t Au & 320 g/t Ag.

- Mapping confirmed mineralized veins extending southwest toward Highlander Silver's Bonita Project.

"The mapping and sampling confirm the extension of high-grade veins southwest toward Bonita, solidifying our view of a continuous mineralized system," said Martin Zegarra Diaz, lead geologist on the Project.

"These results provide a strong foundation for defining drill targets in this emerging district."

Key veins mapped at surface include:

- Esperanza Vein: Exposed over approximately 300 meters with an average thickness of 0.8 meters, narrowing to 0.2-0.3 meters at the northwest and southeast ends.

- Romina Vein: Exposed over approximately 350 meters with an average thickness of 0.5-0.8 meters, narrowing to 0.2 meters toward the northwest.

Between these structures, secondary veins and branches (0.05-0.3 meters thick) have been identified, with minor mineralized features extending southwest, suggesting further continuity in that direction.

These results confirm epithermal-style mineralization rich in Ag, Au, Pb, and Cu, associated with the extension of the Antonella vein system toward the southwest.

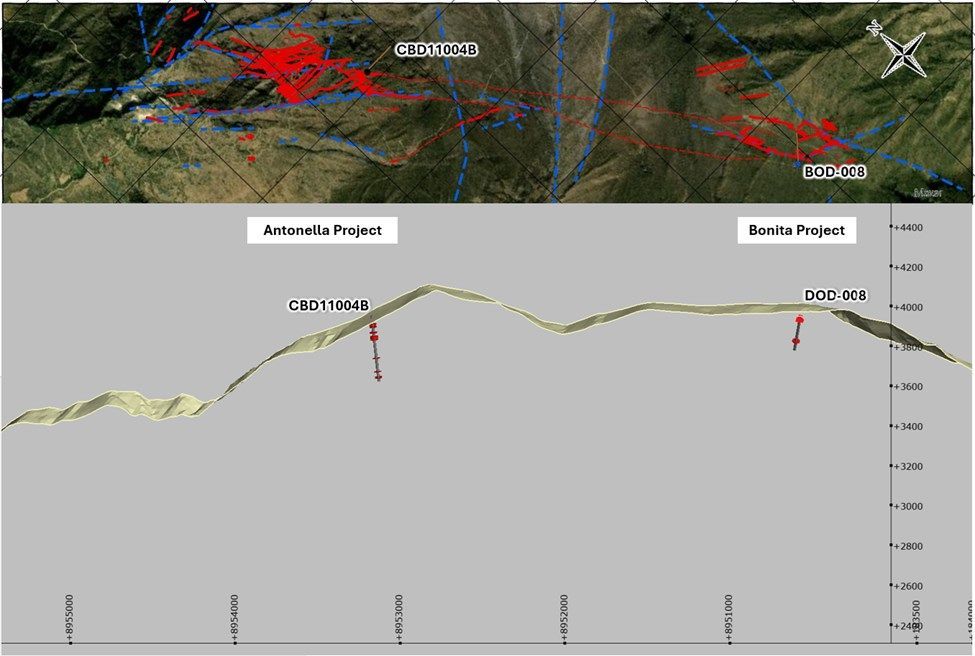

Antonella lies approximately 700 meters northeast of Highlander Silver’s Bonita Project, within the same structural corridor. Daura’s recent sampling correlates strongly with Highlander’s July 2025 Bonita drill results, including broad high-grade intercepts such as 23.1 m grading 4.92 g/t Au and 16.56 g/t Ag (BOD-008). Historical drilling at Antonella also returned notable results, including 17.5 m grading 3.27 g/t Au and 22.6 g/t Ag (CBD11004B). These results collectively reinforce the potential for a continuous high-grade vein system across the district.

Historical drill hole CBD11004B from Antonella’s past drilling, approximately 2,1km from Highlander’s recent drilling at Bonita (shown in Figure 3) intercepted:

- 17.5m at 3.27 g/t Au and 22.6 g/t Ag (from 40.1) including:

- 5.75m at 5.1 g/t Au and 31.9 g/t Ag (from 40.1)

- 3.25m at 6.4 g/t Au and 44.1 g/t Ag (from 42.6)

- 0.95m at 8.87 g/t Au (from 44.9m)

- 0.8m at 19.25 g/t Au and 241 g/t Ag (from 52.55)

- 5.05m at 11.6 g/t Au and 90.5 g/t Ag (from 52.55)

- 0.8m at 15.55 g/t Au and 30.4 g/t Ag (from 56.8)

- 2.75m at 2.4 g/t Au and 25.4 g/t Ag (from 84.65)

- 1.85m at 1.4 g/t Au and 97.5 g/t Ag (from 121.2)

- 0.95m at 1.7 g/t Au and 186 g/t Ag (from 122.1)

Next Steps

Daura will continue geological mapping and sampling across the Antonella concessions, including northern (Estrella 02-19) and southern (Estrella 03-19) blocks. Geophysical surveys using drone-assisted magnetometry are planned to further define structures associated with mineralization. The results will guide drill target definition for upcoming exploration programs.

Investor Relations Agreements

The Company has entered into a consulting agreement (the "Agreement") with Triomphe Holdings Ltd., operating as Capital Analytica ("Capital Analytica"), an arms-length party, (Address: 3786 Glen Oaks Dr. Nanaimo, BC V9T 6H2, Canada; email: info@capitalanalytica.com; Phone: +1 778 882 4551), to provide investor relations and communications services. The initial term of the Agreement is six months, commencing September 8, 2025, during which the Company will pay Capital Analytica $20,000 per month for a total of $120,000, payable in two installments upon their engagement and approximately halfway through the term. The Company has the option to renew the Agreement for an additional six-month term at a reduced monthly rate of $10,000, subject to early termination in accordance with the terms of the Agreement.

As part of the engagement, the Company has granted Capital Analytica 250,000 incentive stock options, exercisable at a price of $0.225 per share for a period of two years. These options are subject to standard investor relations vesting provisions.

Under the Agreement, Capital Analytica will provide a range of services, including ongoing capital markets consulting, social media engagement and enhancement strategies, social sentiment and engagement reporting, monitoring of discussion forums, corporate video distribution, and other related investor relations initiatives. The services are expected to be provided by Jeff French, the President of Capital Analytica. Capital Analytica and Mr. French are not related parties to the Company. Other than the abovementioned stock options, Capital Analytica and Mr. French do not directly or indirectly have any interest in the Company’s securities or any right or interest to acquire such an interest.

About Daura Gold Corp.

Daura Gold Corp. is a mineral exploration company focused on acquiring and advancing a diversified portfolio of precious and base metal assets in Peru. The Company operates with a prospect generator model, emphasizing cost-effective exploration to establish drill targets and secure partnerships.

QA/QC

The work program at Antonella was designed and supervised by Martin Zegarra Diaz, the Company's Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel rigorously prepare and track samples, which are security sealed and shipped to a certified laboratory for analysis.

Qualified Person

All scientific and technical information contained in this news release has been reviewed, verified and approved by Owen D. W. Miller, Ph.D. Member AIG, a qualified person as defined in National Instrument 43-101. Dr. Miller acts as an independent third-party consultant of the Company.

About Daura Gold Corp.

Listed on the TSX Venture Exchange, Daura Gold Corp is advancing high-impact exploration projects in Peru's renowned Ancash region. Daura Gold owns a 100% undivided interest in over 13,000 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target, which is the primary focus of Daura Gold's current exploration efforts.

For further information please contact:

Daura Gold Corp.

543 Granville, Suite 501

Vancouver BC V6C 1X8

William T.P. Tsang CFO and Secretary

(604) 669-0660

Cautionary Statement Regarding Forward Looking Information:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

share this

Other Recent Daura Gold News Releases.