Unlocking High-Grade Gold Potential in Peru's Historic Mining Heartland.

Listed on the TSX Venture Exchange, Daura Gold Corp is advancing high-impact exploration projects in Peru’s renowned Ancash region.

Download Our Corporate Presentation.

Get an in-depth look at Daura Gold's corporate strategy, industry expertise, and project details. Download our corporate presentation to discover the driving forces behind this emerging high-grade precious metals explorer.

Daura Gold Corp. is at the forefront of gold exploration in the renowned Ancash region of Peru, home to some of the highest-grade gold deposits in the world. Our strategic acquisition of Estrella Gold SAC positions us with a substantial land package in this historic district.

Investment Highlights.

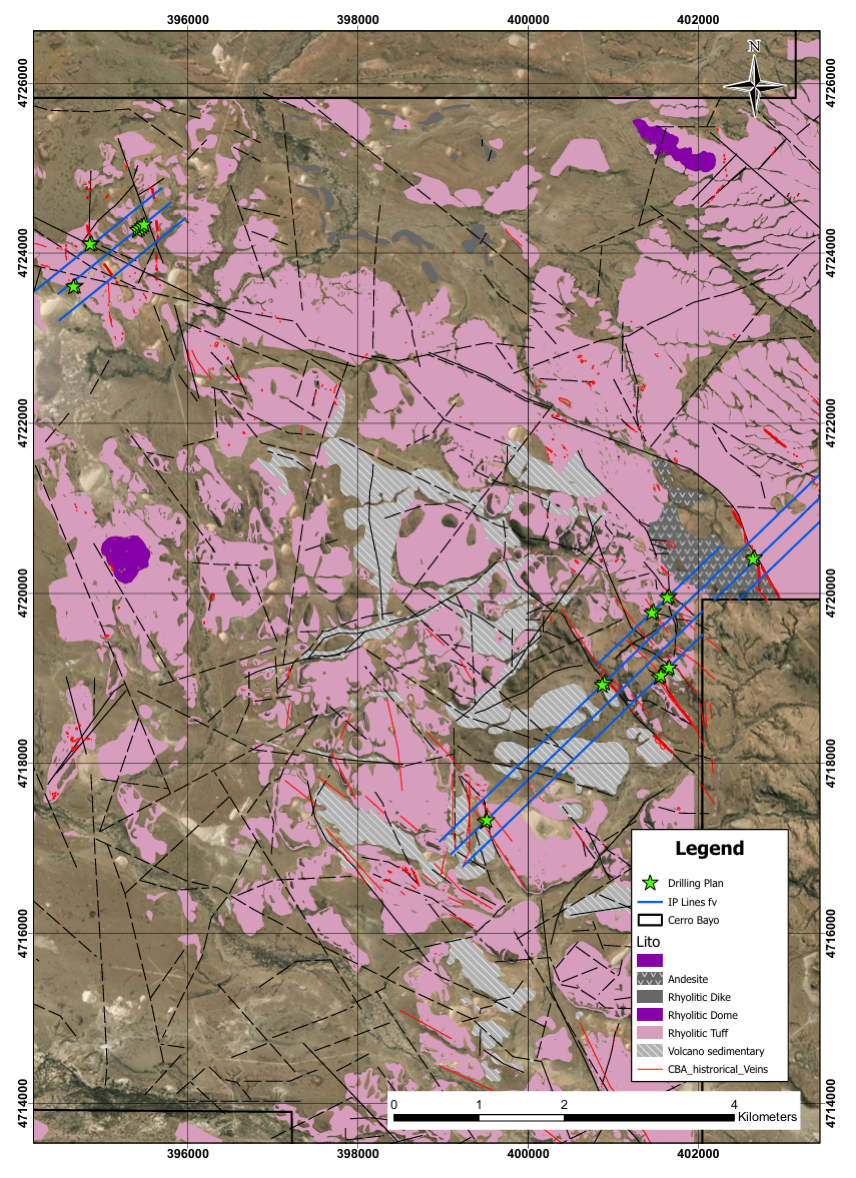

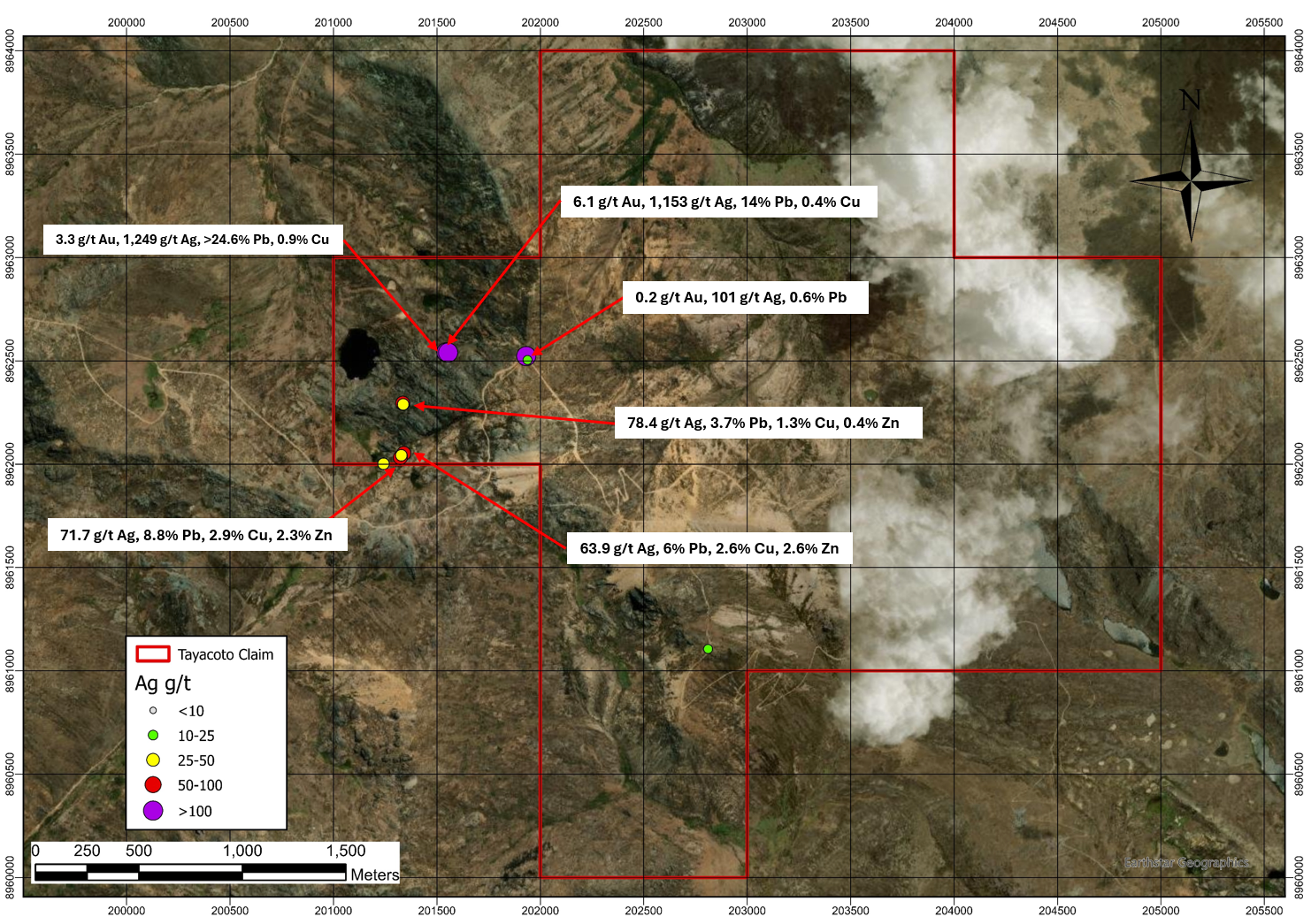

Over 15,900 ha in Ancash, anchored by Antonella (900 ha) and Libélulas (~2,900 ha), plus 5,618 ha at Yanamina with a historic ~207 koz Au resource

DISTRICT-SCALE LAND PACKAGE

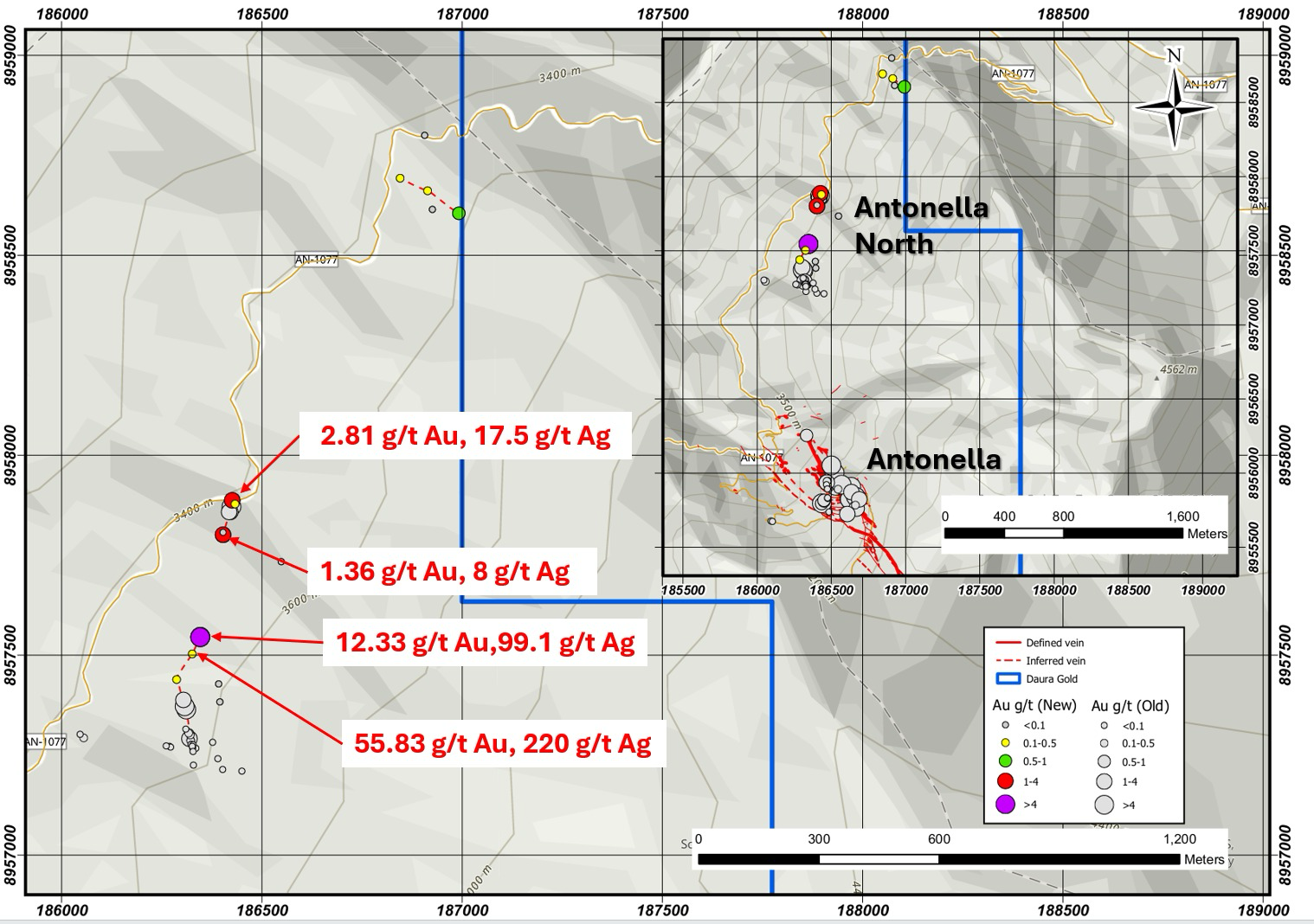

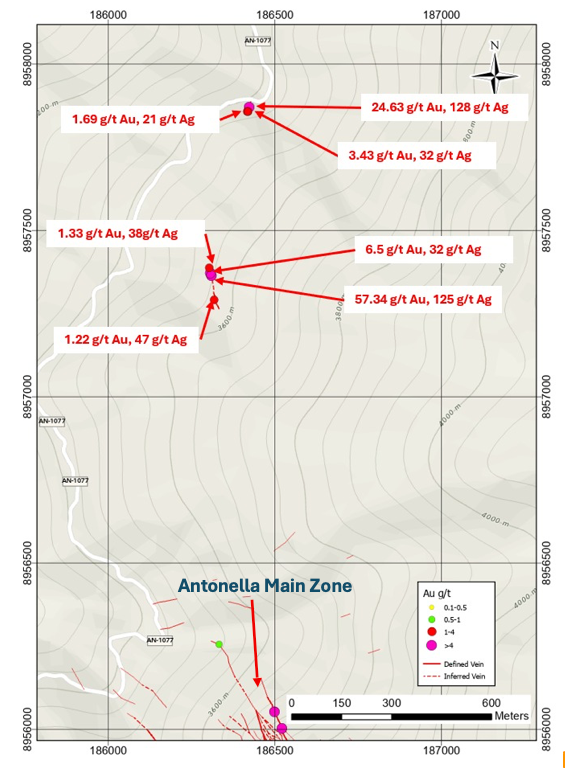

Vein field over 900 ha with ~2,500 m of historical drilling; highlights include 17.5 m @ 3.27 g/t Au & 22.6 g/t Ag (CBD11-004B)—on trend with Bonita.

The Antonella Target

Directly bordering Highlander Silver’s bonanza-grade San Luis/Bonita district; the neighborhood includes Highlander, Barrick and JX Nippon.

Adjacent Signicant Projects

397 rock-chip samples (to 155 g/t Au and 714 g/t Ag) map a continuous NW-SE epithermal vein system; Daura also added ~2,900 ha of strategic claims along this corridor.

DATA-RICH & ADVANCING

Our High-Grade Antonella Target.

The Antonella concession, covering 900 hectares, is the primary focus of our exploration efforts to-date. This area includes the historic Esperanza mine, which has shown promising mineralized veins.

From 2006 to 2012, Minera Silex Peru SRL drilled 2,461 meters across 11 diamond drill holes in the Antonella Daniela I concession. The results have helped de-risk the project and guide our current exploration strategy.

Drill Hole CBD11 004B:

0.8m at 19.3 g/t Au

1.0m at 8.8 g/t Au

0.8m at 15.6 g/t Au

0.95m at 8.9 g/t Au

News and Updates.

Get the latest news and updates from the Daura Gold (TSXV: DGC)

Stay Updated With Daura Gold.

Sign up for our newsletter to receive news releases and exclusive company updates.

We will get back to you as soon as possible.

Please try again later.